According to the IEA, the global energy sector has to be at the heart of action to tackle climate change, as it is responsible for almost three-quarters of greenhouse gas emissions that have already pushed global average temperatures 1.1 °C higher since the pre-industrial age, with visible impacts on weather and climate extremes.

Why is this report important?

The IEA was established in mid-1970s to secure OECD member states’ access to oil, a background which makes today’s report particularly significant. Its previous scenarios, with a prominent role for fossil gas, were used by oil and gas companies to prolong our dependence on fossil fuels. This report, however, despite still containing some risky modelling choices on technologies such as carbon capture, storage and utilisation technologies and biofuels in order to reach net zero by 2050, confirms that new public finance for fossil fuel projects needs to end now.

And how is the world faring right now according to the IEA?

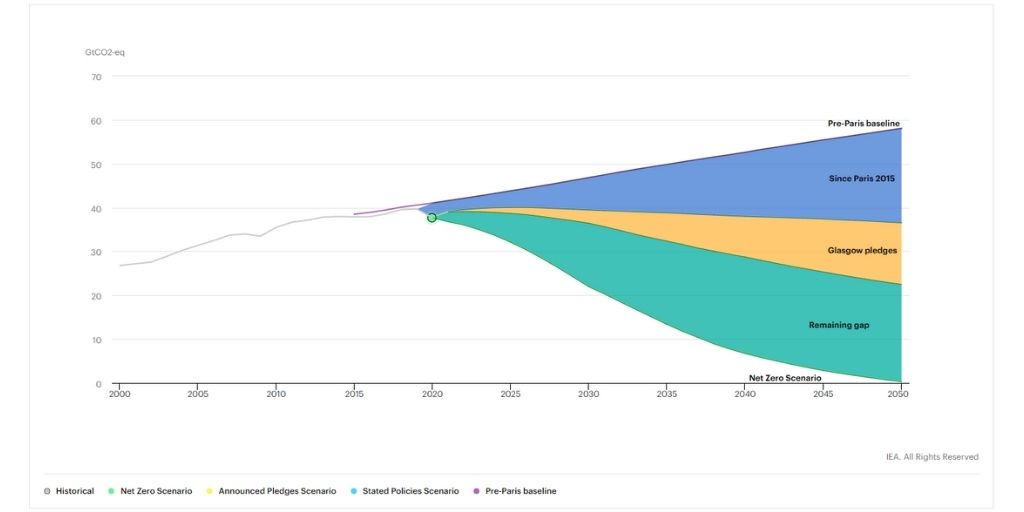

The world is on the track for a catastrophic 2.6°C of warming by 2100 with the measures that have actually been put in place, even taking into account policy initiatives that are currently under development, according to the IEA. Even if we add the newly announced climate pledges in the run-up to November’s COP26 climate summit, we are still going overboard, with a temperature rise of 2.1 °C above preindustrial levels in 2100.

Is there a solution?

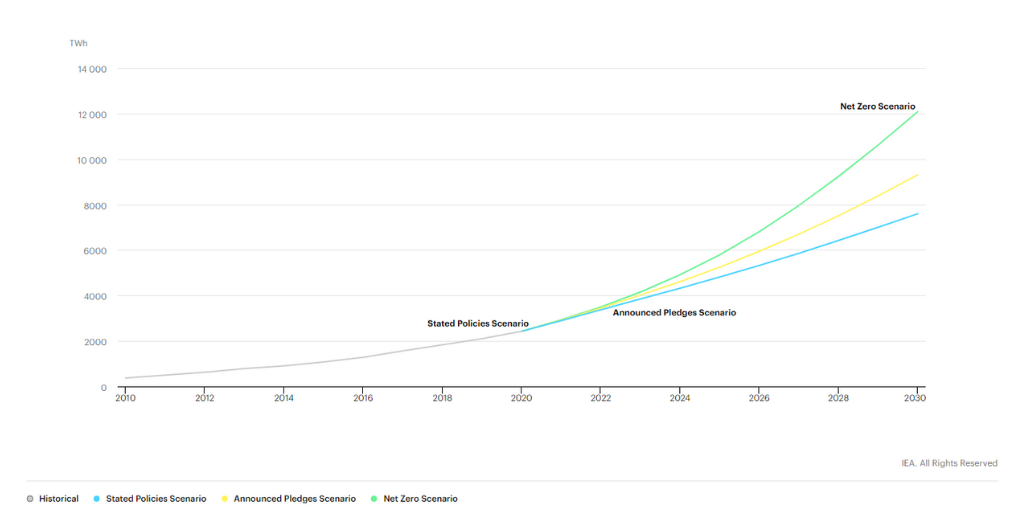

IEA projections show that we need a radical transformation of our energy systems to stay on a course below 1.5°C, clean energy spending must triple to curb climate change – and that of course means ending public finance for new fossil fuel projects.

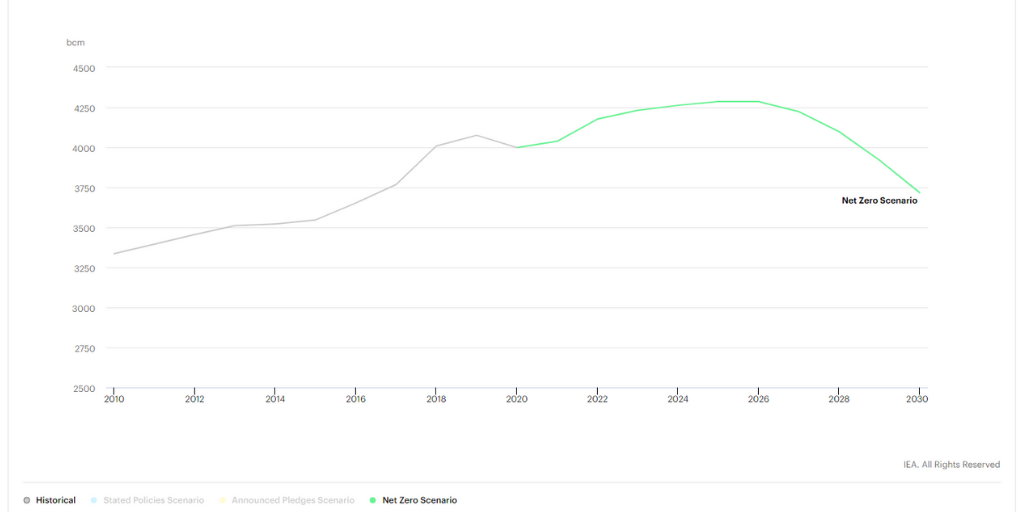

In the net-zero compatible scenario, demand for fossil gas needs to drop sharply from 2025 onwards and reach not more than 1,750 billion cubic metres in 2050. The IEA has reiterated the conclusions from its landmark Net Zero by 2050 report that the necessary rapid drop in oil and natural gas demand means that no fossil fuel exploration is required and no new oil and natural gas fields are required beyond those that have already been approved for development.

The IEA’s recipe to prevent the worst consequences of climate change is to accelerate the decarbonisation of the electricity mix, focus on energy efficiency, and cut methane emissions from fossil fuels.

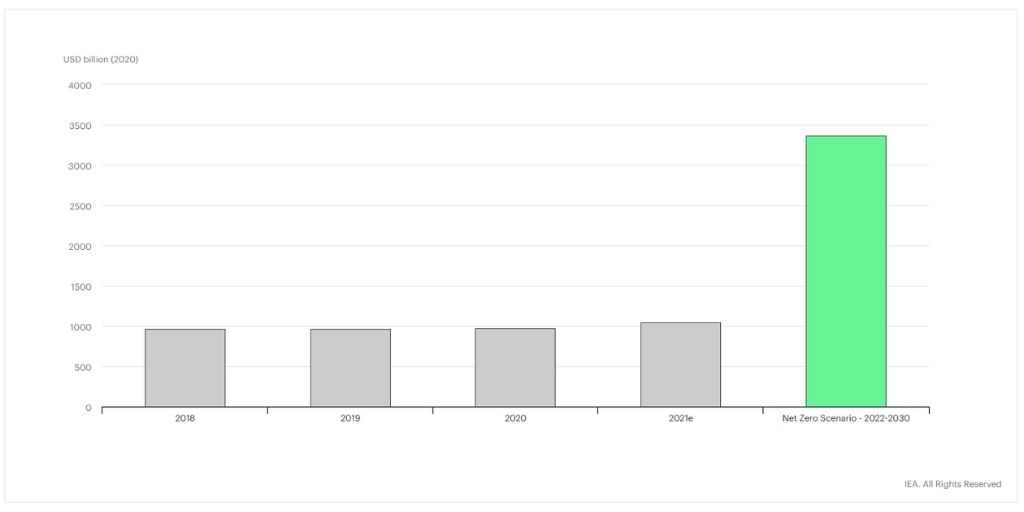

According to the report we need to triple global clean energy investment by 2030. Furthermore, investing heavily in energy efficiency means that the energy intensity of the global economy needs to fall by 4 per cent annually this decade.

The role of public international finance

According to the IEA, a key role in accelerating the energy transformation is reserved for public financial institutions.

Getting the world on track for 1.5 °C requires a surge in annual investment in clean energy projects and infrastructure to nearly USD 4 trillion by 2030. Some 70 per cent of the additional spending is needed in emerging market and developing economies.

Alongside the necessary policy and regulatory reforms, public financial institutions – led by international development banks and larger climate finance commitments from advanced economies – need to play crucial roles to bring forward investment in areas where private financing is missing.

IEA analysis has repeatedly highlighted that a surge in spending to boost deployment of clean energy technologies and infrastructure needs to happen quickly.

However, more investments in renewables alone cannot lead to decarbonisation: public finance institutions also need to send a strong signal to the markets, by stopping all support for fossil fuels, including fossil gas. This is crucial if international development banks want to make a meaningful contribution to climate change mitigation and adaptation and to long-lasting economic transition in its countries of operation.

Never miss an update

We expose the risks of international public finance and bring critical updates from the ground – straight to your inbox.

Project: Fossil gas