Foul play: development banks condone top Ukrainian poultry producer’s abuses

Bankwatch Mail | 17 December 2015

A closer look at Europe’s recent investments in Ukraine’s agriculture sector shows that the failure to apply high transparency standards and social safeguards poses not only business risks but also undermines Ukraine’s democratisation process.

This article is from Issue 63 of our quarterly newsletter Bankwatch Mail

Browse all articles on the right

Amid mounting global security concerns and the second week of the UN climate negotiations in Paris, a development affecting Ukraine and reported by Reuters went largely unnoticed. The International Monetary Fund announced it is to change its lending rules, a move that will permit Ukraine to miss payments on a USD 3 billion debt to Russia and continue to receive Fund support.

Ukraine is currently restructuring its debts to plug a USD 15 billion funding gap under an IMF-led USD 40 billion bailout, so changes to the policy on non-toleration of arrears to official creditors were agreed by the IMF’s Executive Board.

This, of course, is not an isolated case of the west’s political agenda in Ukraine compromising standards and loan conditions when decisions are made at public financial institutions. And the question is if this kind of largesse is in fact justified and beneficial to Ukraine and its people? A closer look at Europe’s recent investments in Ukraine’s agriculture sector shows that the failure to apply high transparency standards and social safeguards poses not only business risks but also undermines Ukraine’s democratisation process.

Who will reap what is being sown?

Agriculture was the only sector of Ukraine’s economy to register growth in 2014. This bolsters first of all GDP growth, badly needed for stabilising Ukraine’s economy and securing debt repayments. Another beneficiary? Cheap food exports to Europe, enabled after the country signed an Association Agreement with the EU. As a consequence, the growing appetite of investors for Ukrainian agribusiness deals has matched the ambition of large industrial agro-holdings in Ukraine to scale up their operations and cash in on new export opportunities.

Meanwhile rural communities, sandwiched between grain and fodder production and animal rearing facilities, have grown wary of both the environmental impacts that the industrial farms stimulate and the rising demands to lease their lands to corporate ‘land banks’, some of up to half a million hectares.

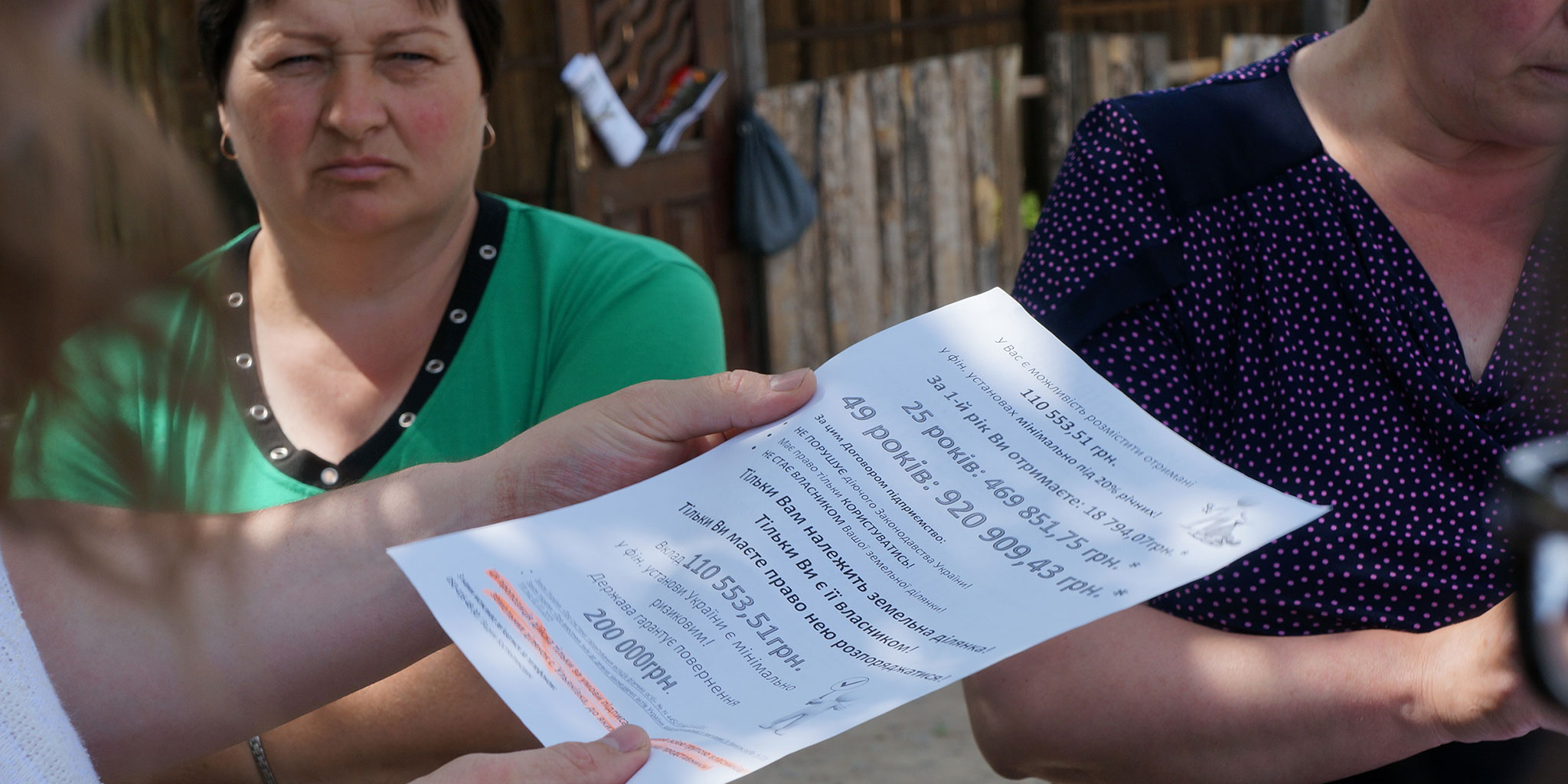

A Myrinovsky Hlibproduct leaflet distributed to villagers, advertising the land lease and promising profits.

Requests for help from these rural communities prompted a Bankwatch fact-finding mission in the company of partner groups to the Vinnytsia region earlier this year, where Ukraine’s poultry producer monopoly, Mironivski Hliboproduct (MHP), has one of its complexes. Owned by one of Ukraine’s richest men, MHP is a vertically integrated corporation involved in all aspects of the value chain, from grain production to chicken slaughter and retail.

Read more

Images and graphs: Large-scale agribusiness in Ukraine and local communities

Blog post | September 14, 2015

Black earth – Agribusiness in Ukraine and the marginalisation of local communities

Study | September 14, 2015

Rural communities in Ukraine bearing the brunt of unchecked agribusiness expansion, say two new reports

Press release | September 14, 2015

Chicken run. The business strategies and impact of poultry producer MHP in Ukraine

Study by SOMO | September 14, 2015

Since 2003 MHP has received more than half a billion euros in investments from public development banks such as the European Bank for Reconstruction and Development (EBRD), the European Investment Bank (EIB) and the International Finance Corporation (IFC) of the World Bank. In addition, a number of private investors and commercial banks such as Dutch banks Rabobank and ING have invested in MHP. Therefore, one of the field visit’s aims was to look into the company’s compliance with these banks’ various environmental and social policies.

The team interviewed more than 100 people, and held meetings with Ukrainian authorities as well as MHP’s international investors. Two reports from this field research, Black Earth and Chicken Run, describe the concerns raised by people in three villages, one already impacted by MHP’s operations and two which are at risk from the company’s expansion.

The stench that accompanies industrial animal farming and the heavy traffic on village streets were evident enough. Yet the main problems that village councils spoke out about were related to the lack of both public consultations and official written information about MHP’s business.

How much water is used, how polluted water is treated, where it is discharged; quantities of manure produced, methods of treatment and utilisation on the fields as fertiliser; how the company is dealing with health risks; what community programmes and transport infrastructure the company intends to fund, and when? These and other questions raised by local people have remained largely unanswered by MHP.

Representatives from village councils also complained that individuals and vulnerable households have been pressured to lease their land in order to allow MHP’s expansion, in spite of the village decisions not to allow chicken rearing facilities in their vicinities.

Birds of a feather…

The company has denied the findings of the two reports. In turn, the banks involved have defended their client, responding that MHP’s operations are generally in line with Ukrainian law and EU standards. These responses are far from persuasive, but it is clear that the investment volumes pledged by the west in support of Ukraine have to be channelled somewhere, and agribusiness is a lucrative sector.

Thus, in October this year, the EBRD’s board of directors approved a new corporate loan of USD 85 million for MHP. Currently Atradius, the Dutch export credit agency, is also considering four export credit requests for MHP.

In several Ukrainian regions, community protests against MHP’s expansion continue nonetheless. Villagers are organising public hearings, demanding information from the company, and physically blocking its attempts to start construction.

MHP’s failure to adequately deal with community grievances carries risks that European banks cannot neglect. Of far more importance than the risk of losing money is the risk that European banks – both public and private – will undermine the political project of democratising Ukraine by backing further oligarch land grabs. Continuing to condone this kind of behaviour, as democratic principles and the interests of rural communities are casually abused, is headless chicken stuff.

Theme: Social & economic impacts | Development

Location: Ukraine

Tags: BW Mail 63 | MHP | agribusiness | agriculture

Never miss an update

We expose the risks of international public finance and bring critical updates from the ground. We believe that the billions of public money should work for people and the environment.

STAY INFORMED