9 reasons why the EU’s bank is no climate leader

Bankwatch Mail | 17 December 2015

In the run-up to, during and now, with a global deal reached, after the Paris climate summit, the world’s largest public lender, the European Investment Bank (EIB), is positioning itself as a climate pioneer. Together with other multilateral development banks, the EIB is posing as the vehicle to distribute these vast sums of money, and as the EU’s house bank, it has a guaranteed role to play in the bloc’s contribution to the fight against climate change, both within Europe and beyond.

This article is from Issue 63 of our quarterly newsletter Bankwatch Mail

Browse all articles on the right

But is the bank really fit for this role? Can the EIB make a break from its history of financing fossil fuels and polluting forms of transportation after decades of cosy relations with the biggest culprits? Here are nine reasons, all related to very recent trends at the EIB, which suggest the bank will have to pull up its climate socks – and fast.

1. Climate finance leader … in five countries

According to an EIB evaluation (pdf), 70 percent of the bank’s EUR 75 billion in climate finance between the years 2010 and 2014 was limited to just five countries: Germany, France, UK, Italy and Spain. During COP21, a further EUR 1bn loan package in support of energy transition in France was announced by the EIB.

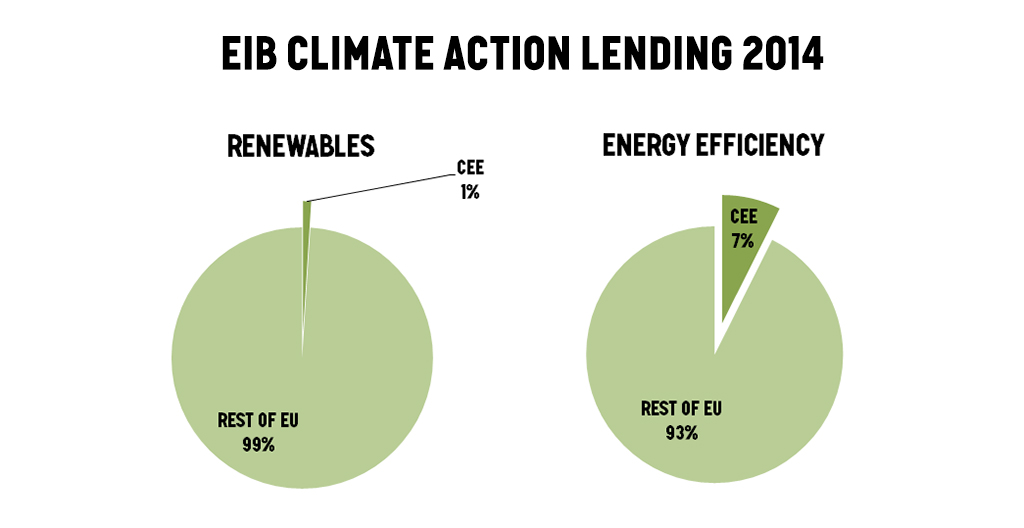

A closer look at the bank’s projects from 2014 that are counted as climate action reveals an even more glaring imbalance: the 13 EU member states in central and eastern Europe (CEE) collectively received less than one per cent (EUR 42 million) of the EUR 4.5 billion the EIB disbursed for renewable energy within the EU in 2014. Of the EUR 2 billion for energy efficiency, only EUR 148 million (7.4 percent) went to the CEE region.

Overall, according to Bankwatch’s tracking, CEE countries received only 10 per cent (xls) of the EIB’s climate action lending in 2014 in spite of the high energy intensities of their economies compared to the EU average.

2. Energy efficiency accounts for just two per cent of EIB lending

The European Commission has underlined the need to fundamentally rethink energy efficiency by introducing the Energy Efficiency First principle which seeks to ensure the consideration of the potential for energy efficiency first in all energy related decisions. The Commission also regularly touts the EIB as an important player for boosting energy efficiency investments in the EU.

Yet the EIB couldn’t be farther away from making ‘energy efficiency first’ a guiding principle for its lending. As a cross-sectoral issue, energy efficiency measures constituted only 2.8 per cent (xls) of the EIB’s total lending in 2014.

3. Massive support for Europe’s car industry

Despite repeated calls to transform the global transport system away from private road transport, car manufacturers received a significant 11 percent of EIB climate finance between 2010 and 2014. As the EIB admits:

“Slightly over 40% of Climate Action RDI [Research, Development, Innovation] volume went to the German automobile sector. […] RDI operations on new RE [renewables] technologies are virtually absent from the Climate Action portfolio”.

Throwing more money at one of the most polluting modes of transportation is not the most effective form of climate finance. Adding insult to injury, car producers have actively circumvented and undermined the promised emissions reduction efforts, which brings us to point four.

4. Generous EIB climate finance for the Volkswagen group

Since 2009 the EIB has loaned the Volkswagen group EUR 1.5 billion from its climate action programme to improve fuel efficiency and reduce emissions from its engines. Without more detailed information from the EIB about Volkswagen’s use of these loans, their contribution to emissions reduction action is unknown.

5. One hand doesn’t know what the other is doing

While the EIB boasts about being a leader in climate finance, it still supports climate damaging projects with billions of euros. The EIB’s sustainability report (pdf) approximates that projects in 2014 resulted in 4.7 million tonnes of greenhouse gas emissions, the equivalent of putting 2.35 million new cars on the road. One such EIB investment is a gas extraction project in Tunisia: this will add another 1.5 million tonnes of CO2 equivalent per year.

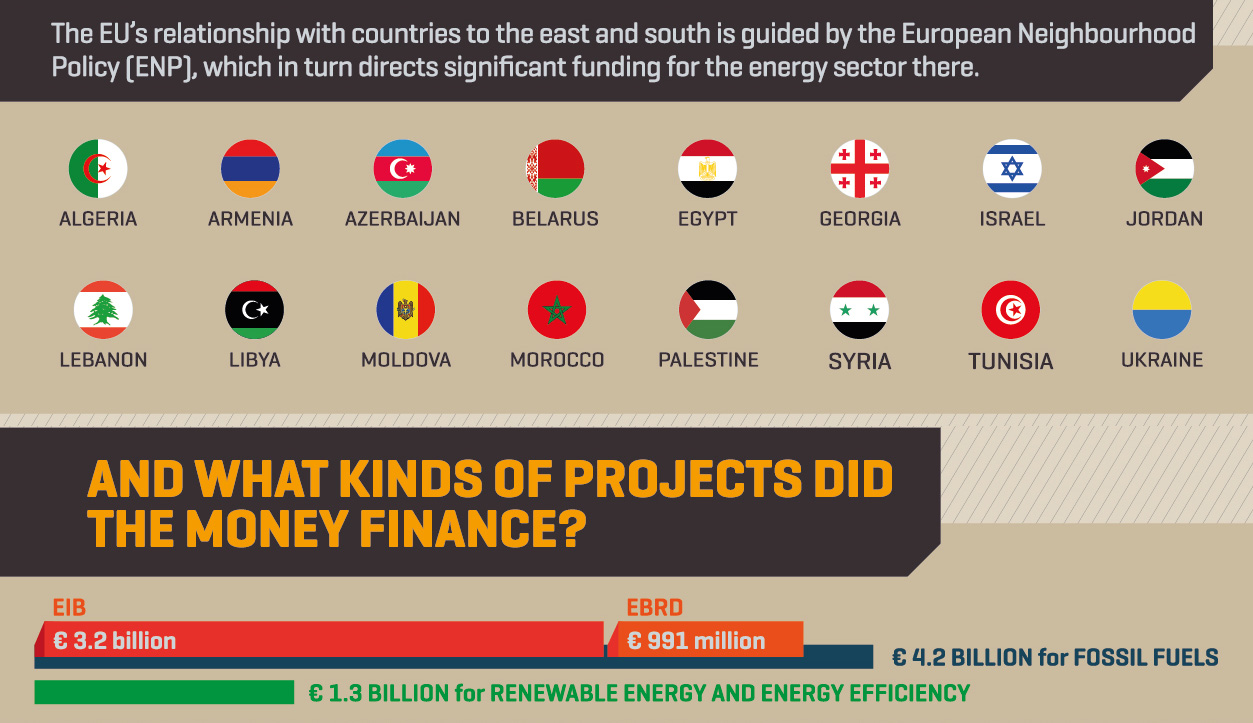

6. EIB fossil fuel finance in European Neighbourhood countries

Between 2007 and 2014, the EIB provided EUR 3.2 billion for fossil fuel projects in 16 countries of the European Neighbourhood Policy. Only EUR 780 million went to renewable and energy efficiency projects, the majority of which was targeted at just one country, Morocco.

7. Turning its back on the EU’s long term climate objectives?

In its new climate lending strategy approved in late September 2015, the EIB decided to drop a reference to the EU’s 2050 low-carbon economy roadmap. Despite bank statements repeatedly naming climate action as a top lending priority since 2010, the new EIB climate strategy fails to commit to EU decarbonisation goals.

8. EIB’s emissions standard for energy production lags behind

The EIB Emission Performance Standard (EPS) for the energy sector is currently set at a level of 550 g CO2/kWh. An EPS is a limit on the amount of CO2 that can be emitted by a power station. Conventional hard coal combustion results in the emission of approximately 850g CO2/kWh, while the most efficient gas power plants emit about 300g CO2/kWh.

During consultations on the EIB’s new climate policy, civil society organisations such as E3G (pdf) and WWF (pdf) pointed out that this level is inconsistent with the EU 2050 climate target since it allows financing for infrastructure, such as new oil-fired plants, with excessively high emissions for reaching the 2050 target. Currently sitting above the minimum level required (450 g CO2/kWh) to support the EU’s climate target, the EIB’s EPS also lags behind similar standards introduced recently by the UK, the US and Canada. This means that the bank may still finance fossil fuel-fired power plants that are less efficient than they could and should be.

9. Climate impact swept under the rug for one third of the EIB’s lending

Even though loans distributed through financial intermediaries, such as commercial banks and private equity funds, totalled 31 percent of EIB lending in 2014, the bank still lacks a methodology to calculate the climate impact of this type of lending.

Theme: Energy & climate

Tags: BW Mail 63 | COP21 | climate action | dieselgate | financial intermediaries | fossil fuels | renewables

Never miss an update

We expose the risks of international public finance and bring critical updates from the ground. We believe that the billions of public money should work for people and the environment.

STAY INFORMED