The European Bank for Reconstruction and Development (EBRD) appears keen to finance a major new pipeline to import fossil gas from Greece to North Macedonia, which would lock the country into increased fossil gas use for decades. Yet when the rationale for this is questioned, the EBRD fails to provide relevant data to justify its claims.

Petr Hlobil, Fossil Free Area Leader | 17 February 2023

In January, Bankwatch published a blog post about the North Macedonia Regional Gasification Project, which involves building a major new fossil gas import pipeline from Greece. We also sent comments on the environmental studies for the project published by the EBRD, seeking a justification for the substantial expansion of fossil gas consumption for a country that has, fortunately, so far not been heavily dependent on large imports of gas – unlike many central European countries.

The EBRD was quite swift in its response (see document). They are very confident, stating that ‘expectations are that gasification will lead to significant reductions in air pollution, and GHG emissions, by enabling the switch to cleaner fuels in populated industrial areas of the country‘ and ‘[c]arbon lock-in risks have also been assessed from technical, economic and institutional perspectives. Overall, our conclusion is that these gas investments are unlikely to displace low carbon alternatives or to prevent or delay the introduction of renewable energy or low carbon solutions.’

However, none of these claims were substantiated by any figures or verifiable data.

Following this letter, this week we had a meeting with EBRD representatives, in which they reassured us that a more detailed justification would be disclosed in the Board Report that is available for the project after its approval by the Bank (however, only for public sector projects like this one).

Those familiar with the Aarhus Convention (which the EBRD refers to in its Access to Information Policy) know that environmental information should be disclosed before a decision is made, not after it, so the public has a chance to engage in meaningful dialogue.

But is the EBRD disclosing such information? We have looked at how the Bank handled the disclosure in a previous similar case.

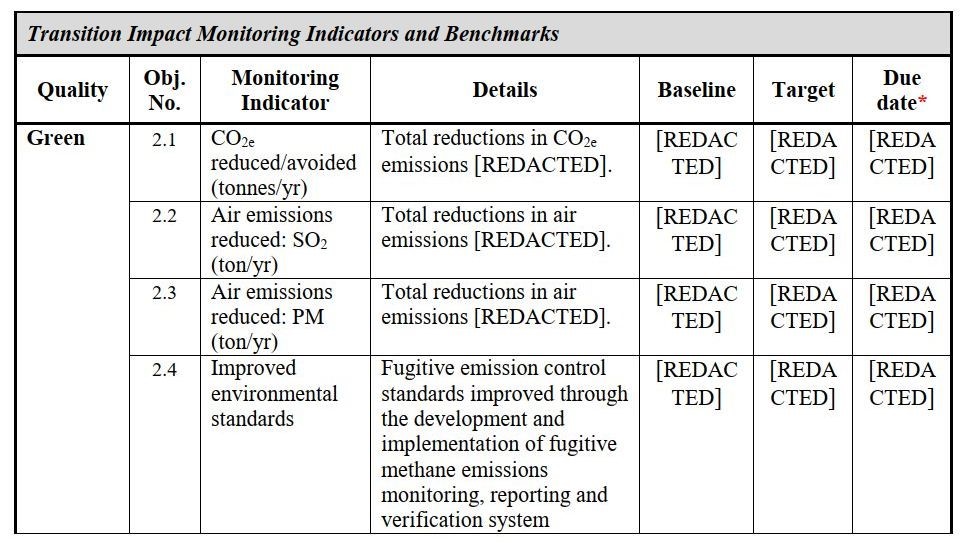

In 2020, the EBRD approved an EUR 80 million loan for a liquefied natural gas (LNG) Floating Storage and Regasification Unit (FSRU) in Cyprus. Still, in the Board Report they redacted nearly all environmental information. The only such information that remains is the project’s direct CO2 emissions, which are expected to be 15 to 20 kilotonnes of CO2. This emissions estimate does not include emissions produced by actually burning the gas, just those created by running the plant as well as by gas leakages. The rest consists of general statements about the climate and other benefits of the project. But for the public, there is no way to verify this, as they have not disclosed their baseline data, targets or deadlines.

Extract from the EBRD’s Cyprus LNG FSRU Board Report

This is a ‘smart’ way for the EBRD to avoid accountability and make sure that it can continue to promote its Paris ‘alignment’ while actually financing fossil fuels, without anyone outside the bank being able to verify or monitor the actual implications of its investments.

Bankwatch has already approached the EBRD to request data and information that would substantiate its bold claims. If it comes up with something, we will be happy to share it – most importantly with the public in North Macedonia, as they will be the ones paying for this project in the end.

Never miss an update

We expose the risks of international public finance and bring critical updates from the ground – straight to your inbox.

Institution: EBRD

Theme: Gas

Location: Greece | North Macedonia

Project: Fossil gas

Tags: fossil fuels | fossil gas