As a result of public resistance to small-scale hydropower projects in the Balkans, from the beginning of 2020, the EBRD will ask commercial banks to refer all high-risk projects – including all hydropower plants – for additional checks. The EBRD also requires them to meet higher environmental standards than previously. The bank will ask that such projects are disclosed to the public on the financial intermediary’s website, finally increasing disclosure on these hitherto hidden projects.

Igor Vejnovic, Hydropower coordinator | 16 May 2019

The Dabrova Dolina 1 hydropower plant is one of the hundreds of projects that the EBRD has financed in the last few years via commercial banks, in this case via Privredna Banka Zagreb (PBZ), part of Intesa Sanpaolo. Though small in volume, these projects can nevertheless cause disproportionate damage. The project is sited on the beautiful blue-green Mrežnica river in Croatia, which is home to a range of species including dice snakes, stone crayfish and otters. More than ninety tufa barriers have gradually formed along its course by calcium carbonate being continuously deposited in the river. Tufa barriers are one of the two habitat types for which the whole river is protected as part of the EU’s Natura 2000 network. The highest of these is the Šušnjar waterfall.

The Šušnjar waterfall dried out in the summer of 2017, in part due to improper operation of the water intake at Dabrova dolina 1 during the dry season.

Increasing transparency in the policy, compared to the draft published in January 2019, was one of the main requests that civil society groups put forward in a joint letter in March 2019. The EBRD’s shareholder countries can take part of the credit for the positive outcome. Credit should be also given to the Management of the bank, which listened to the diverse comments on the initial draft and took steps to improve it.

Šušnjar waterfall before and after Dabrova Dolina 1 started operating

This is just one example why civil society groups around the world asked the EBRD to strengthen its environmental, social and public information standards for intermediated lending.

And it worked. During its Annual Meeting in Sarajevo on 8-9 May, the EBRD launched its revamped Environmental and Social Policy and new Access to Information Policy. Both include more comprehensive requirements for intermediated financing, that reached over EUR 3 billion — 34 per cent of the bank’s overall investments in 2018.

Better checking of projects

According to its new Environmental and Social Policy, the EBRD will require its financial intermediaries to refer all high-risk sub projects back to the EBRD’s in-house team for additional checks. The list of projects with high environmental and social risks includes all hydropower projects. Importantly, these projects will also have to meet higher environmental and social standards, not only compliance with national legislation, which is often deficient.

These changes are a clear sign that the EBRD acknowledges the risks inherent in developing small hydropower projects. The bank has also developed a guidance note on small-hydropower projects that clarifies its requirements for direct financing as well as intermediated lending.

More comprehensive disclosure

Even more importantly, the EBRD will require that financial intermediaries publicly disclose information on the environmental and social risks of any sub-project referred to the EBRD and the proposed mitigation measures to address project risks.

This effectively means that the public will finally know whether public money — the EBRD’s intermediated credit lines — has been used to fund controversial projects such as hydropower plants or any construction works in areas of high biodiversity value.

Had the EBRD had this provision back in the 2008 or 2014 versions of its policy, local communities and civil society organisations might have had a chance to warn the bank and the wider public about publicly-financed damaging projects before the harm was done. The disclosure will still be a subject to “applicable regulatory constraints, market sensitivities or consent of the sponsor of the sub-project” – a provision we hope will not be invoked to limit public access to environmental information but rather to protect legitimate commercial interests of the parties involved.

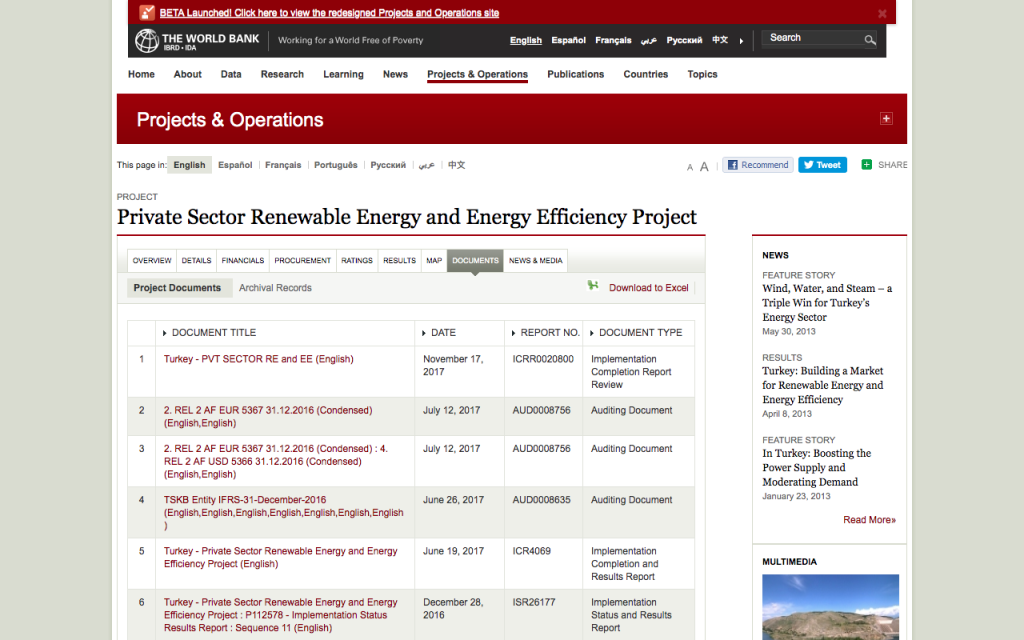

Good practice: two hundred and eight project-related documents pertaining to two credit lines for a total amount of USD 1.1 billion to two Turkish financial intermediaries are available on the World Bank website (example taken from the Open Books report by Oxfam)

Why this has happened

The breakthrough happened due to sustained pressure from the civic groups. Last year, the Blue Heart of Europe campaign together with Patagonia collected more than 120 000 signatures globally, asking the EBRD, European Investment Bank and International Finance Corporation to limit financing for hydropower plants in the Balkans. Since most of the hydropower plants in the Balkans are small, they are more likely to be funded by intermediated credit lines. The EBRD recognised this trend and co-organised a first-of-its-kind summit on hydropower with the Blue Heart campaign in March. Representatives of commercial banks including Erste, Unicredit and Societe Generale attended the event. This was a prelude to the policy changes that were adopted in late April and presented in Sarajevo.

Increasing transparency in the policy, compared to the draft published in January 2019, was one of the main requests that civil society groups put forward in a joint letter in March 2019. The EBRD’s shareholder countries can take part of the credit for the positive outcome. Credit should be also given to the Management of the bank, which listened to the diverse comments on the initial draft and took steps to improve it.

BankTrack’s report

A @BankTrack report suggests that banks readily share information when they see this as in their own interest.

Moreover, #BankingOnValues institutions share information about their investments routinely.

Read more at @ceebankwatch https://t.co/DdS80LDbiz— GABV (@bankingonvalues) March 29, 2019

One of the most important perceived barriers to enhanced transparency of the intermediated lending are banking secrecy laws. A report published by BankTrack in March 2019 showed that this is mainly a myth. Client confidentiality is not an absolute legal requirement in any of the world’s major banking centres. It can be to a large extent overcome by asking client’s consent to publish project-level information.

Next steps

The EIB will consult the public with a draft of its new Standard on Financial Intermediaries this year. Some first steps to listen to public opinion were taken by the bank in February 2019, when representatives of various EIB departments met with NGOs in Luxembourg to discuss intermediated operations.

Indeed, the EIB policy already requires an intermediary or fund manager to publish environmental and social information on specific loans. However, in reality, the EIB does not include this requirement in financing contracts, and it is not done in practice. That’s why Bankwatch has submitted a complaint to the EIB’s Complaints Mechanism (CM), asking the bank to implement its own rules.

Since a significant portion of the EIB’s portfolio is channelled via commercial banks and other intermediaries — EUR 23 billion or 32 per cent of its entire lending in the EU and EUR 23 billion or 36 per cent of its entire lending in third countries — it is important to strengthen provisions on financial intermediary transparency. We will be closely looking how the lessons learned by the EBRD could be used to strengthen policies in intermediated lending in other banks.

Never miss an update

We expose the risks of international public finance and bring critical updates from the ground – straight to your inbox.

Institution: EBRD

Project: Buk Bijela and Upper Drina cascade | Krapska Reka small hydropower plant, Macedonia

Tags: EBRD | EIB | financial intermediaries | hydropower | safeguards