The European Bank for Reconstruction and Development is expected to take a decision tomorrow on whether or not to provide a EUR 300 million loan for a nuclear power plant Safety Upgrade Programme in Ukraine. This article from our quarterly Bankwatch Mail sums up the issues at hand.

, | 11 March 2013

This post is an article from Issue 55 of our quarterly newsletter Bankwatch Mail.

In recent weeks, Alexander Shavlakov, the technical director of Energoatom, the state nuclear operator, acknowledged the reality of the programme, telling a meeting in February of the trade union of Ukrainian nuclear industry workers: “Without the Safety Upgrade Programme, [nuclear] units’ lifetime extension is out of the question. We should be conscious of this.”

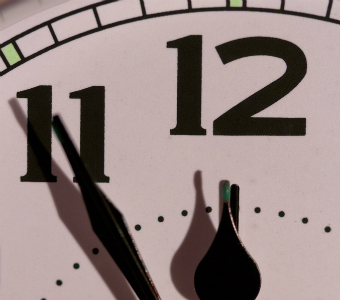

The ‘nuclear safety’ billing of the SUP appears to be blinding EBRD decision-makers to the full implications of the proposed investment, although discussions and negotiations around the deal have been taking longer than expected – the EBRD board date for the decision is now scheduled for March 12, some six months later than planned.

For me, there is a fundamental issue at stake: “Would the proposed EBRD loan help to guarantee the safe operation of Ukraine’s 15 operating nuclear units, 12 of which are designed to finish operating by 2020? Our answer is ‘no’. The SUP has got to be exclusively geared to safety measures, including the decommissioning of old reactors, not prolonging their lifetime.”

Chief among the concerns of campaigners is that the SUP has not been designed to guarantee the safe operation of Ukrainian nuclear units after the expiration of the original design life.

Never miss an update

We expose the risks of international public finance and bring critical updates from the ground – straight to your inbox.

Institution: EBRD

Theme: Energy & climate | Other harmful projects

Location: Ukraine

Project: Zombie reactors in Ukraine

Tags: Bankwatch Mail | EBRD | Ukraine | energy | energy grab | energy security | nuclear | nuclear safety