Brussels, Belgium — Today’s General Affairs Council meeting to discuss the EU’s next Multiannual Financial Framework 2014-2020 (MFF) saw further stalemate between those member states seeking to ensure no cuts to the European commission’s outline MFF proposals, and those member states determined that cuts must occur while insisting that the emphasis must instead be on the ‘quality’ of future MFF spending.

CEE Bankwatch Network, an organisation campaigning for a more sustainable future EU budget, expressed its disappointment that for all the talk of quality, climate mainstreaming, one of the fundamental quality drivers within the current MFF proposals, was noticeably absent from the meeting discussions. [1]

The European Commission has proposed that a minimum of 20 percent of the MFF would be committed to tackling climate change in areas including Cohesion Policy, Common Agricultural Policy, Development Policy and Research and Development. Bankwatch is calling for a 25 percent climate action commitment in the MFF.

Markus Trilling, EU Funds coordinator for Bankwatch, commented:

“With only a few weeks to go now until decision time, these Budget 2014-20 negotiations are starting to make a mockery of the aspirations of Europeans, the pressing need to do something about climate change and the imperative to create sustainable jobs.

“The European commission has proposed a 20 percent allocation for climate action in the MFF, we are saying that a 25 percent climate allocation can really help deliver the EU’s 2020 climate change strategy and get the most out of the future budget, for people living in Europe. The member states, though, as we saw today are shadow-boxing around a negotiating box that without real figures attached to it is looking more and more like Pandora’s box.

“The longer that real figures remain off the table, the more likely it is that climate action will get crunched in the final outcome. Even if some ‘green’ concessions gain agreement, and increased percentages of climate money allocations are introduced, an overall reduced budget for 2014-20 could well lead to the perverse situation where, in real terms, there is less money than in previous budgets for vital climate spending. It’s time to see the figures, and for member states to make the case explicit for a high quality, climate action focused MFF.” [2]

For more information, contact:

Markus Trilling, EU Funds coordinator, CEE Bankwatch Network

Tel: +32 484 056 636

Email: markus AT bankwatch.org

Notes for editors:

1. Bankwatch was one of the signatories to a letter published on September 20 in the European Voice, making the case for increased climate action allocations in the EU budget 2014-20, available at: http://www.europeanvoice.com/article/imported/climate-change-must-be-part-of-budget-talks/75189.aspx

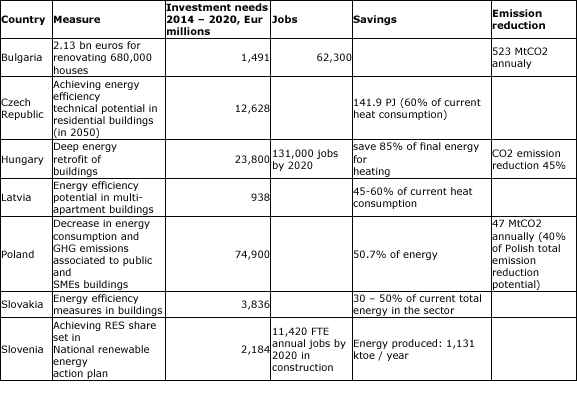

2. [2] A recent Bankwatch study suggests real figures for seven CEE countries by compiling investment needs for the energy efficiency and renewables sectors. Read more in Bankwatch’s press release:

https://bankwatch.org/news-media/for-journalists/press-releases/no-half-measures-investment-needs-energy-efficiency-and-re