Fossil fuels are fast losing their social license. It is becoming increasingly evident that countries’ continued reliance on dirty hydrocarbons escalates the climate crisis, worsens air pollution and enables war.

Long touted as a ‘bridge fuel,’ fossil gas now needs to be recognised by policymakers for the hurdle to the energy transition that it is, and multilateral development banks should urgently end support for gas projects and gas-dependent companies.

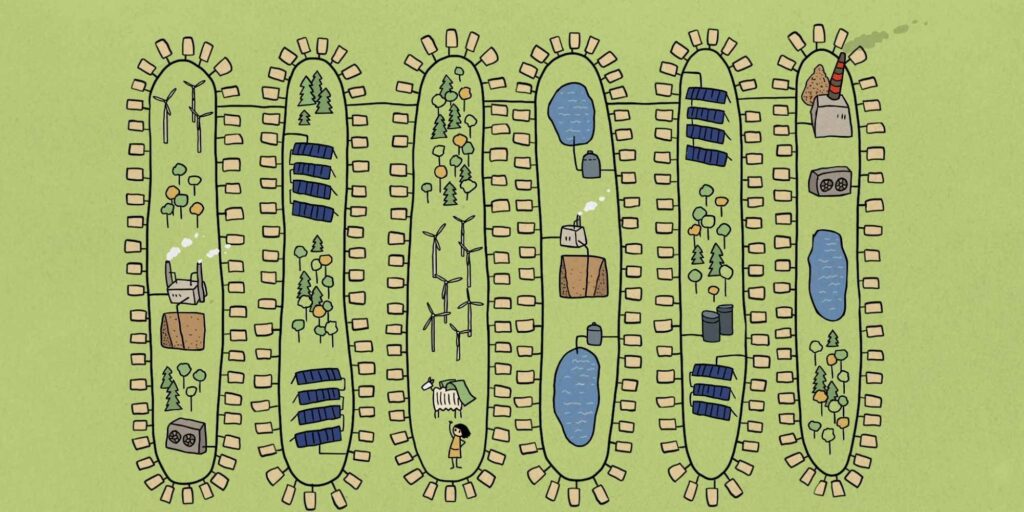

The energy transition has to be just and fast, with citizens, municipalities and workers as critical participants in the process. We are working to ensure no more public money is spent on coal, and public finance is used to accelerate this transition.

Stay informed

We provide updates in English from the Balkans and other coal regions.

IN FOCUS

Fossil gas

Fossil gas is the new coal. Although often labelled ‘natural,’ fossil gas is a major driver of the climate crisis. There is no more room for new investments in fossil gas projects if we are to avert the worst impacts of the climate crisis and set a path towards decarbonisation.

District heating

District heating and individual heating are still dominated by fossil fuels and inefficient burning of wood without regard to sustainability criteria, in combination with a low degree of energy efficiency. This has to change, since heating plays a crucial role in the transition into a clean and zero-carbon economy.

Just transition

No one should be left behind when we reconstruct our world into one driven by clean energy. Working on just transition brings all actors who believe in fair regional redevelopment to the same table: unions, industry, public administration, governments, civil society and others sharing this goal.

Documentary: Turning the Tide

Our documentary exposes, for the first time, the extent of financial support four of the world’s leading multilateral development banks (MDBs) – the World Bank, the European Investment Bank, the Asian Development Bank and the European Bank for Reconstruction and Development – have been providing to the global fossil fuels industry over the past 13 years.

Our analysis shows that since 2008, the oil, coal and gas business has been enjoying no less than EUR 81.5 billion in support from these government-owned financial institutions in the form of loans, grants, credit lines and guarantees.

Coal projects

Ugljevik power plant, Bosnia and Herzegovina

Commissioned in 1985, the 300 MW coal power plant in Ugljevik, Bosnia and Herzegovina, has become famous for emitting more sulphur dioxide than all of Germany’s coal power plants in 2019.

Pljevlja I power plant, Montenegro

The existing 225 MW Pljevlja thermal power plant in the north of Montenegro, near the borders with Serbia and Bosnia-Herzegovina, has been operating since 1982. The plant was originally planned to comprise two units but the second one was never built. The plant, along with the extensive use of coal and wood for heating, has caused unbearably bad air quality in the town.

Kostolac B power plant (B1, B2), Serbia

The Kostolac B power plant, consisting of 2 units of 350 MW each, first entered into operation in 1987. In 2022, the plant delivered 4388 GWh of electricity to the grid, nearly 20 per cent of the country’s coal-based generation.

Latest news

Western Balkans: Civil society groups call on European Commission to strengthen support for just transition

Press release | 4 October, 2024A group of civil society organisations, including CEE Bankwatch Network, are calling on the European Commission and other actors to step up support for a just transition in coal-dependent communities in the Western Balkans.

Read moreUnfit for 55: How EU climate money is supporting gas-fired heating in Slovakia

Blog entry | 3 October, 2024Despite a marked drop in fossil-gas consumption, Slovakia supported district heating systems to run on fossil gas with EUR 55 million from the EU’s Modernisation Fund.

Read moreWestern Balkans: coal pollution increases due to government failures – new report

Press release | 17 September, 2024In 2023, Western Balkan governments’ dereliction of their law enforcement duties again allowed an increase in sulphur dioxide (SO2) pollution from the region’s antiquated coal power plants, according to the sixth edition of Bankwatch’s Comply or Close report, published today (1). Dust and nitrogen oxides (NOx) pollution from coal plants also continued to exceed legal limits.

Read moreRelated publications

Kolubara mine “mired in crime and corruption”

Bankwatch Mail | 7 March, 2013 |At a press conference in January, Serbia’s energy minister Zorana Mihajlović spoke out strongly against the Kolubara mining complex, describing it as being “mired in crime and corruption” while also announcing that a thorough investigation is ongoing into corrupt practices by the Kolubara management. Bankwatch believes that this latest confirmed scandal at Kolubara should be giving the EBRD serious pause for reflection as it considers yet another loan to the Serbian electricity company EPS, heavily implicated in these latest revelations.

EBRD enters Kosovo: Past IFI failures must be heeded

Bankwatch Mail | 7 March, 2013 |Kosovo has just celebrated the fifth anniversary of independence. In these five years, Kosovo has achieved membership of certain international financial institutions (IFIs): having already joined the IMF and the World Bank, on December 17 last year Kosovo became the 66th member of the European Bank for Reconstruction and Development. Yet what can Kosovo’s citizens expect from EBRD membership?

NGOs suggest key recommendations for Oyu Tolgoi copper and gold mine project in Mongolia

Advocacy letter | 15 February, 2013 | Download PDFThe letter, signed by 39 organisations, outlines ongoing concerns about the Oyu Tolgoi copper and gold mine in Mongolia, which is currently under consideration for financing by the European Bank for Reconstruction and Development. The project, one of the largest and most complex infrastructure investments proposed by the EBRD, poses a significant environmental and social risk to the local communities, as well as to the country at large.