MEPs call on EIB not to disburse funds to Sostanj lignite power plant

Publication | 30 January, 2013This letter from Claude Turmes (Greens), Alojz Peterle (EPP) and Kathleen van Brempt (S&D) calls upon the European Investment Bank’s President Werner Hoyer to withhold the disbursement of EIB funds for the Šoštanj lignite power plant project in Slovenia due to ongoing corruption investigations and the project’s questionable economic viability.

Read moreEIB Capital Increase May Not Further EU Goals

Press release | 14 January, 2013Brussels — Last week’s ten billion euros capital increase for the European Investment Bank (EIB), allowing the bank to lend 60 billion euros extra over the next three years, must come with clear commitments from the bank to stop loans for dirty energy, say NGOs.

Read moreThe EIB’s energy lending in the spotlight

Publication | 14 January, 2013The European Investment Bank has opened a review of its energy policy and called for the public’s views on the key future challenges for the bank’s operations. The lending figures to the energy sector until 2011 show that the policy must better guide the EIB’s lending towards EU policy objectives of de-carbonisation of the energy sector.

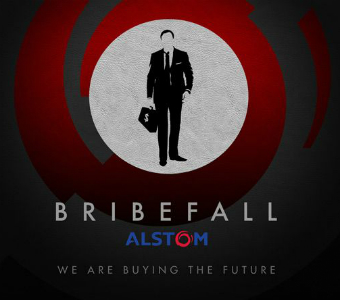

Read moreThe worst company of the year – Vote for Alstom in the People’s Public Eye Awards 2013

Blog entry | 8 January, 2013Alstom, the constructor for the Sostanj lignite power plant might just be the worst company of the year. You can vote for Alstom in the Public Eye Awards until January 23.

Read moreALSTOM nominated for “Prestigious” Public Eye Awards

Press release | 7 January, 2013The French energy and transport conglomerate Alstom is one of the seven finalists for the People’s Public Eye Awards 2013. The nomination is a result of information submitted by NGOs Focus Slovenia, SHERPA France and CEE Bankwatch Network, in which dubious business practices of the company across the world are highlighted — often linked to proven corruption or corruption allegations surrounding the awarding of contracts.

Read moreEuropean Commission, DG Environment comments to the EIB energy sector lending policy consultations

Publication | 7 January, 2013While not part of the EIB’s energy policy review process as such, following an official request for information Bankwatch has received comments submitted by the Directorate-General for Environment of the European Commission to the EIB as part of ongoing exchanges between the bank and the Commission.

Read moreExpert assessment of Alstom’s business ethics

Publication | 4 January, 2013The French energy and transport conglomerate Alstom is one of the seven finalists for the People’s Public Eye Awards 2013. This assessment – done by experts from the Institute for Business Ethics of the University of St. Gallen, Switzerland – takes a look at international treaties and Alstom’s conduct in relation to them.

Read moreBankwatch input for the review of the European Investment Bank’s energy lending policy

Publication | 30 December, 2012In Autumn 2012, the European Investment Bank has launched a process of reviewing its energy lending policy in order to align it better with EU climate goals. Bankwatch’s comments lay out the case for fossil fuels to ‘fall out’ of the EIB’s future energy lending policy – and for an overall more ambitious, and substantially more climate-sensitive EIB energy policy.

Read moreCounter Balance contribution to the EIB’s energy sector lending policy consultation

Publication | 28 December, 2012Counter Balance is a coalition of European environmental and development organisations that looks into the European Investment Bank’s financing with a focus on non-EU activities. The submission therefore emphasises this area, yet also comments on the questions of coal, carbon markets and nuclear lending, given the global effects of these energy sources.

Read moreUrgewalt/Klimaallianz (DE) Comments on EIB energy policy

Publication | 28 December, 2012In their comments on the upcoming new EIB energy policy the German NGO urgewald and the environmental coalition Klimaallianz focus on issue of coal lending and call for no more public money support for coal fired power plants, neither new plants nor retrofitting.

Read more