The energy dissonance: How EU development funds fuel climate change while leaders talk decarbonisation

EU leaders repeatedly voice commitments to spearhead the global effort to tackle climate change, primarily through long-term decarbonisation targets. But a Bankwatch research into the EU’s development funds for neighbouring regions finds that considerably more European taxpayer money is supporting fossil fuels than facilitating a sustainable energy transition.

17 November 2015

EU leaders repeatedly voice commitments to spearhead the global effort to tackle climate change, primarily through long-term decarbonisation targets. But a Bankwatch research into the EU’s development funds for neighbouring regions finds that considerably more European taxpayer money is supporting fossil fuels than facilitating a sustainable energy transition.

The main findings of the study will be presented today at the European Parliament. The study’s executive summary can be found here:

https://bankwatch.org/sites/default/files/ENP-energy-exec-summary.pdf

An infographic summarising the findings can be found here:

https://bankwatch.org/publications/infographic-how-eu-development-funds-fuel-climate-change

Guiding the EU’s relations with 16 countries to its east and south, the European Neighbourhood Policy instructs the bloc’s public investments in these countries and should in part help spur sustainable development. Between 2007-2014 EU [1] financial support to the energy sector in Europe’s neighbourhood exceeded EUR 9 billion.

Of the 16 European Neighbourhood countries [2], the top four recipients were Ukraine (EUR 2.5 billion), Egypt (EUR 1.8 billion), Tunisia (EUR 1.1 billion), and Morocco (EUR 1.1 billion). Together, these four countries received nearly 75 percent of the total EU financing.

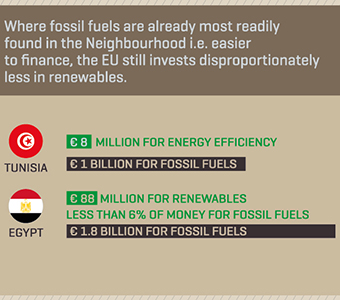

Yet a new Bankwatch analysis shows that fossil fuel projects in European Neighbourhood countries have received three times more EU financial support than energy efficiency and renewable energy projects.

For example, while Tunisia received nearly EUR 1 billion in support of fossil fuels, it obtained only EUR 8 million in investment for renewables and energy efficiency. In Egypt, the EU financial institutions contributed with EUR 1.5 billion to hydrocarbons. At the same time, their support for renewables amounted to EUR 74 million, that is 5 percent of the financing for fossil fuels.

This discrepancy is most evident in the lending portfolio of the European Investment Bank (EIB) which provided the largest volume of financing. During this period, the bank extended loans to 51 projects totalling EUR 5.6 billion. But while energy efficiency and renewable energy projects were awarded EUR 780 million, fossil fuel-related project received from the bank no less than EUR 3.2 billion.

The second main funder, the European Bank for Reconstruction and Development (EBRD), supported 105 projects with a total of EUR 2.8 billion. Of this amount, energy efficiency, wind, solar and other sustainable energy projects in European Neighbourhood countries were granted EUR 582 million over this eight years period. Yet gas, oil and other fossil fuel projects were granted EUR 557 million in 2014 alone, of a total EUR 991 million between 2007 and 2014.

“The EU lenders talk of leading Europe’s neighbourhood to the next level when it comes to renewable energy. But their track record says the opposite,” Klara Sikorova, Senior Researcher with Bankwatch and lead author of the report. “Europe must radically change course if its rhetoric on sustainable energy investments is to become a reality.”

For more information contact:

Manana Kochladze

European Neighbourhood Co-ordinator

CEE Bankwatch Network

manana@bankwatch.org

Tel.: +995 599 916 647

Klara Sikorova

Senior Researcher

CEE Bankwatch Network

klara.sikorova@bankwatch.org

Tel.: +420 274 822 150 (ext. 27)

Notes to editors:

[1] The analysis examined financing from the major EU financing institutions and energy cooperation programmes including the European Investment Bank, the European Bank for Reconstruction and Development, Neighbourhood Investment Facility, Inogate and the European Atomic Energy Community.

[2] The European Neighbourhood countries include Algeria, Armenia, Azerbaijan, Belarus, Egypt, Georgia, Israel, Jordan, Lebanon, Libya, Moldova, Morocco, Palestine, Syria, Tunisia and Ukraine.

For more see here: https://bankwatch.org/ENP-energy

Never miss an update

We expose the risks of international public finance and bring critical updates from the ground – straight to your inbox.

Institution: EBRD | EIB

Theme: Energy & climate

Location: Tunisia | Egypt | Azerbaijan | Ukraine | Morocco

Project: Southern Gas Corridor / Euro-Caspian Mega Pipeline | Zombie reactors in Ukraine

Tags: ENP-energy