European Fund for Strategic Investments (EFSI)

Tasked with stimulating the European economy, the new investment fund may just become an extention of the European Investment Bank’s normal lending with very limited additional (green) finance.

Stay informed

We closely follow international public finance and bring critical updates from the ground.

Background

Facing protracted economic downturn in Europe, the European Commission in 2015 launched with great fanfare an Investment Plan for Europe with its financial arm, the European Fund for Strategic Investments (EFSI).

Under the auspices of the European Investment Bank, the EFSI aims to stimulate the European economy and mobilise private investments by providing funding for projects with a higher risk profile than ordinary EIB activities.

Yet although the fund has been tasked specifically with financing, among others, energy efficiency and renewable energy projects and with promoting cohesion, it may not live up to this promise.

There is a risk that, being managed by the EIB, the EFSI either follows standard EIB lending practices or that ‘greener’ EIB loans are shifted to the EFSI category – with very limited additional green finance overall.

Assessment after the first year of operation

An in-depth examination by Bankwatch of the EFSI’s operations after one year suggested that cash that should be flowing into projects that boost environmental sustainability is instead fuelling outdated carbon-intensive projects like motorways, airports, and fossil-fuel infrastructure.

An opinion by the European Court of Auditors confirms that evidence for the EFSI’s added value is scarce at best, as Reuters reported in November 2016.

Also beneficiaries and national promotional banks were in doubt about the added value of the fund, as an independent report by the consultancy Ernst & Young showed in November. The report also warned that the EFSI may even crowd out existing investments.

Read more:

The Best Laid Plans – Why the Investment Plan for Europe does not drive the sustainable energy transition

An article with highlights from the study

Good and bad projects

The good: “Third industrial revolution”

The “third industrial revolution” project in Nord-Pas-de-Calais, France incorporates numerous smaller projects all working for a zero carbon energy system for the entire region. The particular financing mix could potentially serve as a good example for an investment platform under EFSI.

The bad: Bratislava bypass

The EUR 1.76 billion public-private partnership project of a 27km motorway around Bratislava is filled with controversy. It will come with high costs, damage biodiversity and likely not solve local transport problems.

Background: funding set-up

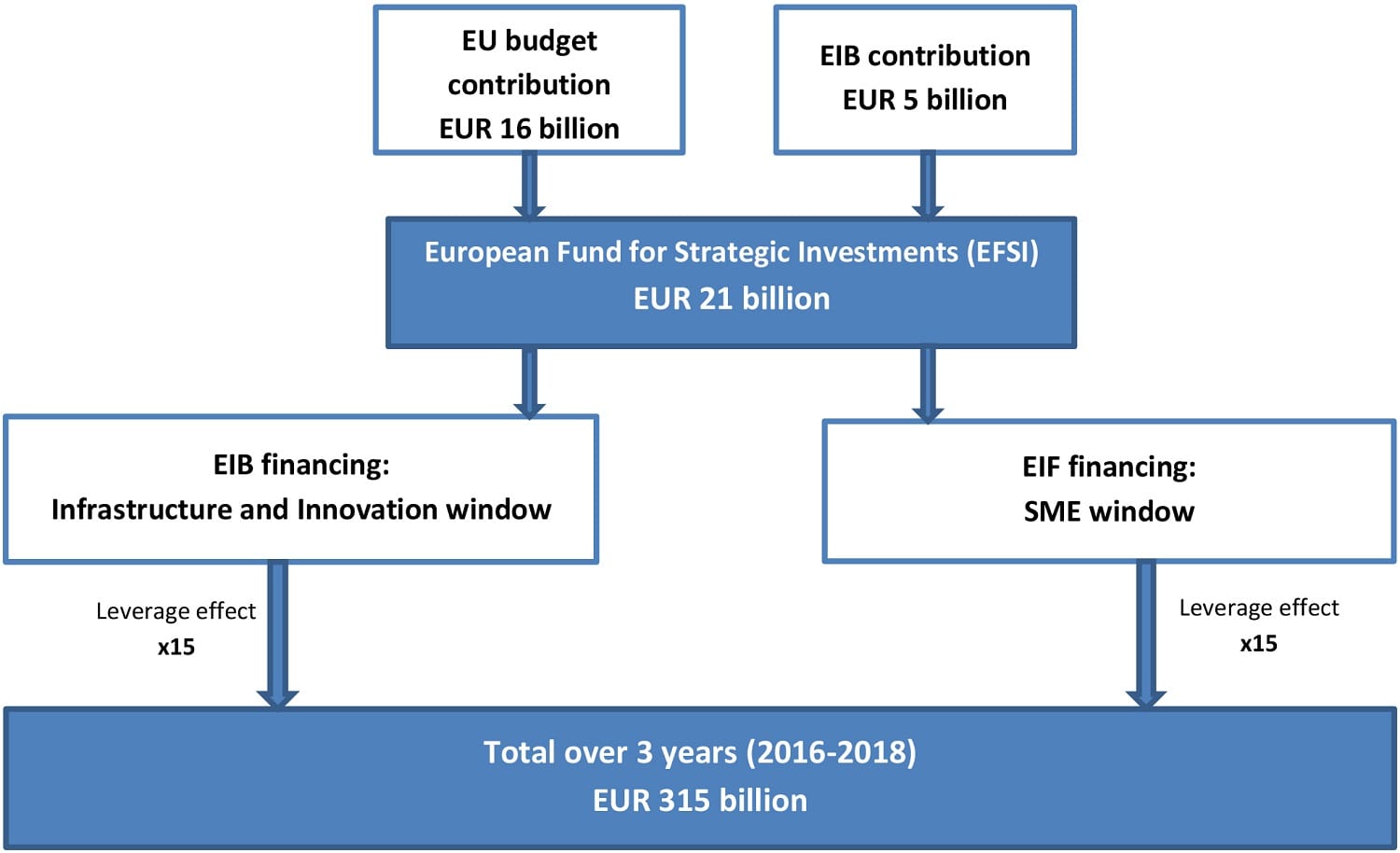

Based on a guarantee of EUR 16 billion from the EU budget and complemented by a EUR 5 billion allocation of the EIB’s own capital, the EFSI’s investment target is EUR 315 billion until 2018.

Latest news

To avoid failures of recovery planning, cohesion funding must offer transparent public engagement

Blog entry | 22 December, 2021The European Union’s next long term budget and recovery package is a generational opportunity to tackle the climate crisis and build resilient societies. Yet, a lack of transparency and unwillingness to engage stakeholders, firstly with the recovery plans and now the Cohesion Funds, threatens to imperil a bounceback instead of steering the European Green Deal.

Read moreThe EU’s flagship investment scheme must not become backdoor for fossil fuel financing

Blog entry | 7 October, 2019A half trillion euro subsidies scheme and part of the so-called Juncker Plan, the European Fund for Strategic Investment (EFSI) has been portrayed by its promoters, the European Commission and the European Investment Bank as a major success story, albeit with little evidence to back such claims.

Read moreZa wcześnie, by ogłaszać sukces Planu Junckera?

Bankwatch in the media | 2 October, 2019Zbyt małe wsparcie dla inwestycji na rzecz środowiska czy przekazywanie środków finansowych dla niewłaściwych regionów to jedne z krytycznych uwag raportu na temat „Planu Junckera”, przygotowanego przez europejskie organizacje pozarządowe „Counter Balance” oraz „Bankwatch”.

Read moreRelated publications

European Fund for Strategic Investments: How to ensure sustainability, good governance and added-value

Briefing | 31 January, 2016 | Download PDFThe European Fund for Strategic Investments (EFSI) aims to leverage through the European Investment Bank (EIB) financing for a total of EUR 315 billion in new projects by 2018. The guarantee fund should target projects with a higher risk profile than normal EIB investments and should as well increase lending for investments which significantly contribute to achieving European common policy objectives (“European added-value”). This briefing outlines necessary improvements in the EFSI implementation to realise these aims.

European Fund for Strategic Investments (EFSI): Smart, sustainable and inclusive growth – recommendations for the Delegated Act establishing a scoreboard of indicators

Briefing | 21 June, 2015 | Download PDFEuropean Fund for Strategic Investments: Legal requirements to ensure additionality and added-value of EFSI operations

Briefing | 15 May, 2015 | Download PDFThe first four projects that the European Investment Bank announced for financing under President Juncker’s EUR 315 billion investment initiative, the European Fund for Strategic Investments (EFSI), reveal the structural inconsistencies of both the EFSI legal set-up and the EIB procedures themselves. For the time being there is no genuine guarantee about the additionality of EFSI financing and added-value to EU’s long-term economic development objectives, in particular the multiple dividends of a decarbonised and decentralised energy system with substantial energy savings at its heart.