Repression and carbon lock-in required for security and sustainability?

Bankwatch Mail | 14 May 2015

With construction of the Trans-Anatolian gas pipeline (TANAP) in Turkey getting under way, the Trans Adriatic Pipeline (TAP) consortium awarding contracts for the construction of access infrastructure in Albania, and Russian pipeline plans lagging behind, the Southern Corridor for Azerbaijan’s gas exports to Europe is increasingly looking like a done deal. Or at least that is what the project promoters would have us believe.

This article is from Issue 62 of our quarterly newsletter Bankwatch Mail

Browse all articles on the right

Of course, the Nabucco gas pipeline project failed to reach this stage, but South Stream was scrapped last December, two years after the construction of Russian onshore facilities had commenced and just months after the awarding of contracts to foreign firms for the laying of the offshore section.

Meanwhile, the European Bank for Reconstruction and Development has now twice postponed a decision on investing half a billion dollars in Lukoil’s share in the second development of the Shah Deniz gas field – crucial for the EU destined pipelines – in the Caspian Sea. The EBRD board approval for the Lukoil deal, initially pencilled in for February this year, was first postponed to May and has now been moved to July. It’s hard to guess at what official obstacles might still be standing in the way of EBRD decision-makers rubber-stamping the Russian company’s involvement in the diversification of gas supply to Europe. Nevertheless, there are various reasons for a public bank not to be going anywhere near Lukoil and the Southern Gas Corridor.

Read also

Europe’s Caspian gas dreams – a nightmare come true for human rights in Azerbaijan

Blog post | May 14, 2015

Energy security for Europe or profit for Lukoil?

Blog post | December 4, 2014

Pipe dreams – why public subsidies for Lukoil in Azerbaijan will not reduce EU dependency on Russia

Publication | January 21, 2015

Strengthening Aliyev’s authoritarian regime

Azerbaijan has not invaded another country, and thereby put itself directly in the same economic sanctions category as the EU’s primary energy partner Russia. Yet while the Caspian state has embarked of late on a charm offensive aimed at European leaders involving energy deals and the hosting of international sports events, its premier Aliyev has copied Vladimir Putin’s example of clamping down on press and political freedoms.

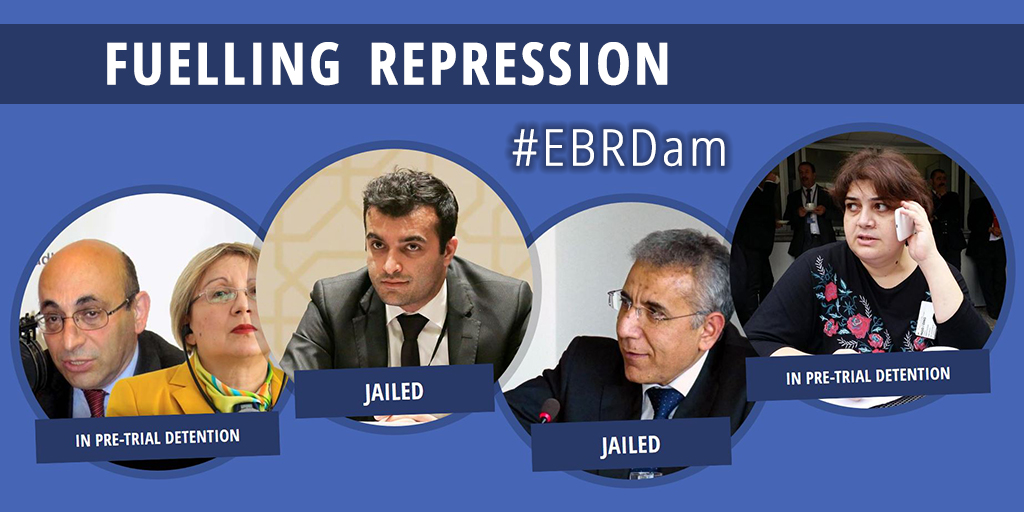

The increasingly authoritarian regime, whose power is fuelled by oil revenues, has jailed eighty political prisoners, more than Russia and Belarus combined. In April this year two human rights defenders – Rasul Jafarov and Intiqam Aliyev – received sentences of six and a half and seven and a half years respectively in politically motivated trials. Other rights activists like the Yunus family and journalist Khadia Ismailova were detained last year and now await trial on trumped-up charges.

A Bankwatch interactive shows prominent examples of prosecuted human rights activists in Azerbaijan and invites you to send a message to the EBRD and European leaders.

False energy security comes at a huge price

The Southern Gas Corridor is expected to add a mere 10 bcm per year starting from 2020, with that volume projected to double at some stage in the future. The Shah Deniz field, recently dubbed ‘gigantic’ by the Financial Times, and the significance of Azeri gas has been hyped since the Ukraine-Russia military and gas conflicts reached boiling point in 2014. However, what the diversification advocates are less vocal about is the fact that Shah Deniz’s 20bcm constitutes little more than five percent of gas supply to the EU – hardly a game changer in the EU’s overall gas supply architecture.

Perhaps the ‘gigantic’ billing for the Southern Gas Corridor stems from its exorbitant price tag. When compared with other schemes aimed at improving interconnection within the EU to address the needs of the most vulnerable EU member states, for example the EUR 1.5 billion Eastring proposal, the Southern Gas Corridor’s investment needs of more than USD 45 billion dollars are hard to justify.

At the same time there continues to be huge energy savings potential in the countries most dependent on Russian gas supply in central and eastern Europe. Multi-billion euro investments could be better targeted at reducing the consumption of all fossil fuels in the region, rather than being pumped into yet more fossil fuel lock-in under the guise of switching from coal to gas dependency.

Gas demand continues to fall

Eurogas reports that in 2014 gas consumption in the EU fell by 11 percent since 2013, following ten percent, two percent and four percent declines in 2011, 2012 and 2013 respectively. Brand new gas plants in western Europe are standing idle, but receiving public subsidies for peak supply capacity. Globally, wind and solar energy is forcing coal and gas fired generation out of the market much faster than had been anticipated by energy analysts. In Europe, according to an analysis published just last month from UBS bank’s energy market team, a consequence of the renewables march has been an accelerating rate of coal and gas-fired generation shut-downs: 70GW of fossil fuel derived power has disappeared in the last five years, with substantial further cuts predicted.

Studies by Bankwatch and others have also estimated that increased gas imports promoted by projects on the European commission’s Projects of Common Interest (PCI) list will exceed predicted gas demand in the five scenarios of the commission’s own Energy Roadmap 2050, as all scenarios foresee decreases in gas imports. Of the 248 projects on the Commission’s PCI list, more than 100 involve natural gas transmission, storage and liquefied natural gas, and at least 15 are aimed at increasing EU gas imports. Regrettably, less attention is given to smart grid projects – projects that can address fluctuations in renewable energy generation as effectively as reserve (mostly idle) gas capacities.

Is all this gas import and gas interconnection infrastructure needed? Some interconnectors could certainly help in providing diversification options – in the event of Russian gas supply disruptions – by moving volumes from oversupplied to vulnerable countries. Gas import pipelines, on the other hand, have no place in a Europe supposed to be embarking on ‘decarbonisation’.

In whose interest?

The question of who makes these vital energy decisions also stands: gas consumers and taxpayers? Countries that need to diversify their energy supplies? Or supplier countries? In the protracted, messy history of competing Caspian export pipeline projects, how did the TANAP/TAP option end up prevailing over Nabucco and South Stream?

While the EU was arguing that South Stream was not in compliance with its competition rules, Azerbaijan and Turkey, together with interested state-owned and private corporations, took decisive strides to advance the option most suitable to them. The selection of TAP as the European export pipeline by the gas producers’ consortium at Shah Deniz was the coup de grace to Nabucco, led by mid-sized companies from the countries on the pipeline route.

With Aliyev in the driver’s seat, the Southern Gas Corridor can turn for financing to Azerbaijan’s USD 34 billion sovereign wealth fund. Nevertheless, European public finance will not only be crucial in the shape of the EBRD’s USD 500 million investment in Lukoil’s Shah Deniz participation, not to mention likely future investments in TAP, but also through the less visible financial support being extended to hook up south-eastern European countries to major gas pipeline spines.

Gas may be slightly less damaging for the climate than coal. However, the proclaimed coal to gas transition is nothing more than a fossil fuel switch, and nothing less than a climate action fraud.

Theme: Energy & climate | Social & economic impacts | Development

Location: Azerbaijan

Project: Southern Gas Corridor / Euro-Caspian Mega Pipeline

Tags: Aliyev | BW Mail 62 | Lukoil | Shah Deniz | Southern Gas Corridor | freedom of speech | human rights

Never miss an update

We expose the risks of international public finance and bring critical updates from the ground. We believe that the billions of public money should work for people and the environment.

STAY INFORMED