Never a dull moment in Slovene power plant soap opera

Publication | 14 December, 2012On November 30, the same day as the national government was under fire in the most heated protests Slovenia has seen in years, Slovenia’s ministers of finance and infrastructure added fuel to the flames by signing contracts with Simon Tot, director of the Sostanj lignite power plant for the controversial EUR 1.3 billion Sostanj Unit 6. These contracts prepare the ground for the signing of a state guarantee contract for a EUR 440 million loan from the European Investment Bank (EIB) for the project.

Read moreGrey area alert – IFI sponsored PPPs the latest big thing in Kazakhstan

Publication | 14 December, 2012While it is not to be unexpected for the public to attempt to scrutinise the effective performance of governmental agencies, in recent years in Kazakhstan it has been far from obvious that many resources and services, projects and finances are being provided by international financial institutions (IFIs). Indeed, very often it is the IFIs that act as catalysts for various government programs, reforms and ideas that are subsequently adapted via the bureaucratic apparatus to Kazakhstan’s reality.

Read moreUnsustainable energy future for EU neighbourhood region challenged

Publication | 14 December, 2012Europe’s neighbouring countries, from the Western Balkans to Ukraine, are intent on pursuing unsustainable energy futures that rely heavily on coal and nuclear. The draft energy strategy of the European Energy Community, recently open for public comments, is no big departure from the national plans, as Bankwatch found out when compiling comments to the draft – and, moreover, this reliance on coal and nuclear energy could end up receiving EU support and financing.

Read moreMore questions than answers as new EBRD mining policy is chiseled out

Publication | 14 December, 2012After long delays and more than three years in the making, the European Bank for Reconstruction and Development (EBRD) finally in early November published its new mining sector policy. Yet both the consultation process and the final outcome have left “consulted stakeholders” disappointed.

Read moreMore gold money lined up for controversial EBRD client

Publication | 14 December, 2012The EBRD’s board of directors is set to decide on December 12 whether or not to extend further significant financing to Canadian gold mining firm Dundee Precious Metals (DPM). This time the EBRD may invest up to USD 45 million in a ‘five-year revolving corporate debt facility’ to DPM valued at USD 150 million.

Read moreA useless sham – Review of the Oyu Tolgoi Copper and Gold Mine Environmental and Social Impact Assessment

Publication | 14 December, 2012The potentially EBRD supported Oyu Tolgoi copper/gold mine in southern Mongolia project poses significant adverse social and environmental impacts. This in-dept review – based on our own research as well as that of expert reviewers – shows that the Environmental and Social Impact Assessment (ESIA) is a non-starter and deeply flawed. The study is complemented by detailed expert analyses in five annexes.

Read moreNew report shows World Bank tough talk on climate is just a mirage in Mongolia’s Gobi desert

Press release | 14 December, 2012Ulaanbaatar, Mongolia – Just one week after its grim warning during the UN climate talks in Doha that the world is on a path towards a four degree-rise in global temperatures, the World Bank is set to approve financing for yet another coal plant. The plant will power a giant mining complex in Mongolia’s South Gobi desert, fuelling climate change and violating the Bank’s own policies, argues a new analysis from advocacy groups.

Read moreBankwatch Mail 54

Publication | 14 December, 2012In the ‘aftergloom’ of two major inter-governmental get-togethers – the latest UN climate talks in Doha and the EU budget summit in Brussels – Bankwatch Mail 54 discusses the revision of the energy lending policies at both the EIB and the EBRD – an opportune moment for both banks to show real climate ambition and turn their backs on fossil fuels. In an interview the new EBRD president Sir Suma Chakrabarti shows that much is moving as the bank juggles such hot potatoes as potential support for Monsanto’s expansion into our region while trying to lay down new roots in post-Arab Spring north Africa.

Read moreFinancial alchemy in Slovenia’s energy sector still results in lignite, not gold

Blog entry | 11 December, 2012Even with the latest investment plan for unit 6 at the Sostanj lignite power plant (TES 6), the project’s economics are (surprise, surprise) still distinctly shaky as an independent analysis shows. Nonetheless, the project looks ever more likely to get a state guarantee from the Slovene government.

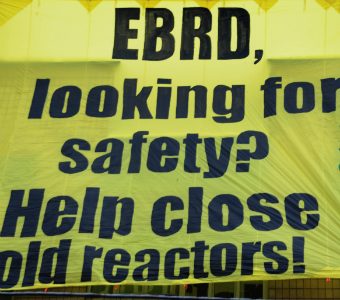

Read morePublic action in Ukraine: Reminding the EBRD of the meaning of nuclear safety

Blog entry | 7 December, 2012A protest action held today in front of the EBRD office in Kiev by Greenpeace and Bankwatch highlighted the dangers of Ukraine’s plans to prolong the operations of its 15 nuclear reactors. The groups called on the European Bank for Reconstruction and Development (EBRD) to take safety more seriously than Ukrainian authorities and invest in decommissioning rather than lifetime extensions.

Read more