More than a third of the European Investment Bank (EIB)’s EU lending is carried out via intermediaries. Yet most of this money disappears into a black hole, with no information published about the final beneficiaries and no checks by the EIB about their environmental and social impacts. The EIB’s new safeguard framework is supposed to address this, but the draft text leaves the Bank far behind its peers.

Pippa Gallop, Southeast Europe Energy Advisor | 21 September 2021

Ilovac Dam

The EIB’s financial intermediaries take various forms, including private equity funds, investment funds, commercial banks and state-owned development banks. These help the EIB to reach smaller clients than it would otherwise be able to finance.

The EIB’s global lending via intermediaries amounted to EUR 22.6 billion in 2020. In the EU, credit lines accounted for over one-third of the Bank’s operations in the same year. In addition, the European Investment Fund, a risk finance facility which is a part of the EIB Group, reached almost EUR 13 billion in financing entirely directed through financial intermediaries.

Yet despite years of civil society organisations and the European Parliament raising the alarm, the public has little idea of what happens to this money and whether it is effectively used.

Financial intermediary projects – far from small and harmless

There is a common perception that sub-projects financed via intermediaries are small projects with low risks. But the examples we have uncovered so far show that such projects come in all different shapes and sizes with all sorts of impacts.

For example, small hydropower plants have wrought immense damage across southeast Europe. The EIB has financed more than 27 such plants through financial intermediaries since 2010. These include Ilovac in Croatia, via the Croatian Bank for Reconstruction and Development (HBOR) and the operation of the Blagoevgradska Bistritsa cascade in Bulgaria via Allianz BG.

However, the exact number and many of the names of the plants remain unknown due to the Bank’s refusal to systematically disclose information about sub-projects funded via intermediaries. For example, information from the Serbian pledge registry shows that the EIB also financed the Beli Kamen and Komalj plants in the Zlatibor Nature Park, Serbia, via Credit Agricole Srbija, but the Bank did not respond when we sent information about the case and asked about its involvement earlier this year.

Small hydropower projects are often built in remote and unspoilt mountainous areas of southeast Europe, frequently without carrying out environmental impact assessments and often resulting in entire stretches of rivers and streams drying out for much of the year. Monitoring and enforcement is almost impossible due to the remote locations and the fact that project developers are often well-connected businesses who are usually not touched by law enforcement agencies.

In addition, private equity funds financed by the EIB can invest in companies of any size, including those with serious environmental and social impacts. For example, in October 2019 the EIB confirmed that it had decided not to go ahead with direct financing for the 340,000 tonnes per year Vinča municipal waste incinerator in Serbia, after its own due diligence confirmed that the project would likely interfere with Serbia’s ability to meet EU circular economy targets for recycling. The EIB’s decision was welcomed by civil society organisations, but it turned out that the EIB-financed Marguerite II Fund has remained a shareholder in the project company despite the EIB pulling out. The case clearly shows how little influence the EIB has over its intermediaries’ investments in reality.

The EIB’s current approach

The EIB’s current 2009 Environmental and Social Statement makes relatively clear the requirements for financial intermediaries to adhere to EU law as well as national law and the EIB’s Standards. But the Bank usually delegates environmental and social checks on intermediated investments to the intermediaries themselves, as well as project monitoring. The idea is that the EIB assesses the intermediaries’ capacity to do so before providing them with loans or equity.

But the cases mentioned above show this does not work in practice: at least some intermediaries do not have capacity for or interest in undertaking thorough due diligence. Indeed, as long as the intermediary gets its loan back, the public does not know about its involvement in the project, and local law enforcement institutions do not do their work adequately, there is no real incentive to undertake detailed environmental and social checks or projects monitoring, as there is little financial or reputational risk for the intermediary.

A complaint by Bankwatch to the EIB’s Complaint Mechanism in 2019 on the Bank’s blanket refusal to disclose a list of intermediated hydropower sub-projects in southeastern Europe resulted in a finding that the Bank must check on a case-by-case basis whether it can disclose sub-project information rather than assuming it cannot.

In 2019, the EIB adopted Environmental, Climate and Social Guidelines on Hydropower Development (Hydropower Guidelines), which clarifies how to apply the Environmental and Social Standards specifically to hydropower. The Guidelines contain very useful sections and requirements such as the referral of hydropower projects financed via financial intermediaries to the EIB for due diligence, public disclosure of hydropower projects by the financial intermediary, and the importance of a strategic approach to hydropower (i.e. that the impacts should be assessed first at the level of the river basin and only later at the project level).

The Hydropower Guidelines are a very welcome step forward. However, they need to be embedded in the EIB’s Environmental and Social Policy or Standards, in order to be binding on the EIB and its intermediaries. They also only relate to hydropower, not other sectors, so equivalent cross-sectoral rules need to be introduced.

The EIB’s draft new Policy and Financial Intermediaries standard

In June 2021 the EIB published a new draft Environmental and Social Policy and 11 Standards which clients have to follow. For the first time, the Standards will include one specifically on Financial Intermediaries.

The draft Policy is much less clear than the existing Statement on the need for projects to be in line with EU law – and mentions EU law only in passing. The draft Financial Intermediary Standard clarifies that sub-projects in the EU, EFTA, candidate and potential candidate countries have to be in line with EU law, but for those in other countries it only mentions ‘applicable national legislation and the relevant EIB Environmental and Social Standards.’ A financial intermediary needs to be able to clearly tell how to apply EU law, but will not be able to do so from this short summary.

The draft Standard also still delegates responsibility to the EIB’s intermediary clients to screen and carry out due diligence on sub-projects, as well as monitoring the projects. There are two problems with this. First, unlike in the Hydropower Guidelines, there is no obligation for the intermediary to refer any projects (for example projects which would or may require an environmental impact assessment in the EU) to the EIB for due diligence and monitoring.

This would be alright if all projects which are likely to have significant social or environmental effects were excluded from intermediary lending, but the second issue is that they are not: the ‘regularly amended’ EIB list of excluded projects dates from 2013, and does not even exclude projects with high CO2 emissions, in line with the EIB’s Energy Lending Policy. The list should have been updated as part of the Environmental and Social Policy and Standards revision, but has not been.

So intermediaries may (point 14 of the draft Standard) refer high risk sub-projects to the EIB but are given no instructions on what sub-projects are considered high risk. The standard leaves it entirely to the discretion of the FI to decide which sub-projects it will consider as having potential significant environmental and social impacts and risks which should be reported to the EIB and it also leaves it entirely to the discretion of the EIB to require the FI to report such risks to the Bank.

There is also no requirement for intermediaries to publish information about the sub-projects they are financing. Point 7 of the draft Financial Intermediary Standards requires them to comply with ‘sustainability disclosure requirements under national and EU legislation which is applicable to their activities’ if in the EU or EFTA, and if in the rest of the world, to comply with national legislation and public information on its policies and procedures for assessing and managing the environmental and social impacts and risks of sub-projects.

This is a red herring. National and EU legislation does not usually have any provisions requiring commercial banks – and often also national promotional banks – to disclose their sub-projects and beneficiaries. So requiring them to comply with such legislation is of no help in improving transparency. Similarly, for the rest of the world, a bank’s ‘due diligence policies and procedures’ are of little interest without seeing which projects they are applied to in reality and how.

Recognising the ongoing controversy around hydropower, in 2019, the EIB’s Hydropower Guidelines made a step forward on this issue, stating that: ‘Where the EIB is providing financing to an FI, the FI will disclose the list of hydropower projects it is financing on its website.’ Yet the new draft FI Standard makes no reference to intermediaries having to disclose any specific information about sub-projects.

All of this puts the EIB out of step with its peers, who have undertaken considerable improvements in their financial intermediary policies in recent years.

The EIB’s peers move ahead

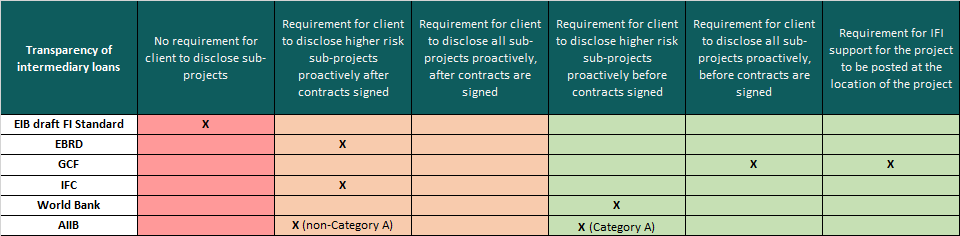

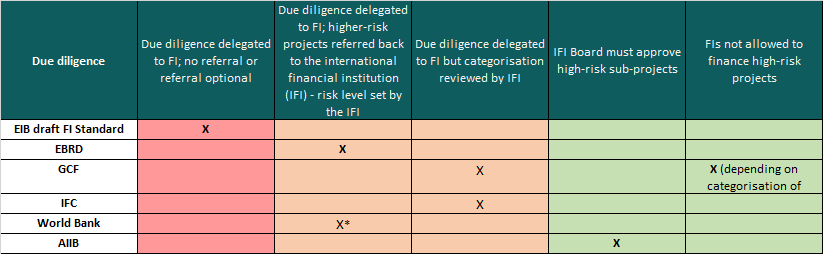

The International Finance Corporation (IFC), the Asian Infrastructure Investment Bank (AIIB) and European Bank for Reconstruction and Development (EBRD) have all committed to improve disclosure for financial intermediary loans in higher-risk sectors, while the Green Climate Fund is the clear leader in this field and requires the disclosure of all sub-projects. The World Bank has also already for years required disclosure for higher risk projects before sub-projects are signed.

The definition of higher risk sectors requiring disclosure and additional due diligence by the multilateral bank lender varies, but the EBRD’s definition includes all Category A projects – those which are always subject to Environmental and Social Impact Assessment (and are listed in the EBRD’s Environmental and Social Policy) – plus a list of project types which might not always be subject to a full environmental assessment procedure, but are nevertheless defined by the EBRD Policy as high-risk, e.g. activities that occur within or have the potential to adversely affect an area that is legally protected.

The EBRD has re-introduced an obligation for intermediaries to notify the bank when considering any high-risk projects listed on this ‘referral list’, at which point the EBRD then becomes involved in the due diligence process.

The China-led Asian Infrastructure Investment Bank has also recently revised its Environmental and Social Framework to include increased AIIB staff responsibility for monitoring and supervision of what it calls ‘Higher Risk Activities’ funded via FIs. There is also a new requirement for AIIB to have prior approval of high-risk sub-projects, and environmental information on Category A sub-projects must be disclosed before approval, and on all other higher-risk sub-projects within a year of financing.

The Green Climate Fund, whose investments are all carried out through intermediaries, has a different approach, having different accreditation levels for different entities, enabling some to finance more risky investments than others, depending on their capacity to assess and manage the risks. Even in this case, the Fund reviews the sub-project categorisation awarded by the accredited entities for specific sub-projects before they are approved.

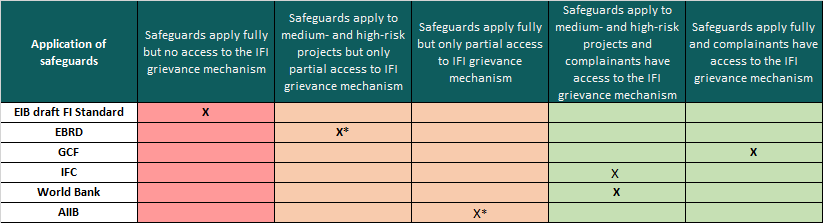

The tables below show how the EIB’s draft Standard performs in comparison with selected other international financing institutions.

* If the World Bank does not think the FI has capacity, the Bank will review high risk projects itself and demand prior approval.

* The EBRD and AIIB’s recourse mechanisms can only carry out compliance reviews on the banks’ compliance with their standards, which may limit the scope of their treatment of cases involving financial intermediaries.

What now for the EIB?

The EIB’s draft Policy and Financial Intermediary Standard need a significant overhaul before being approved. The EU’s house bank must stop hiding around one-third of its lending and must take responsibility for its environmental and social impacts.

The Bank should follow the IFC’s example and stop providing general-purpose loans to intermediary clients¹. It should ring-fence intermediated investments in a legally enforceable way to support specific low-risk projects that truly advance EU policy goals.

The Policy and Financial Intermediary Standard need to clarify that all EIB-financed operations must comply with EU law, the EIB’s Environmental and Social Standards and all EIB sectoral policies. The Bank’s 2013 exclusion list must be updated to at least mirror this: For example, intermediaries must not finance any unabated fossil fuels, as required in the 2019 Energy Lending Policy.

The EIB needs to introduce a referral list in its Financial Intermediary Standard, defining higher-risk sub-project types that need to be referred to the Bank for due diligence and monitoring. This should include sub-projects with social impacts, those which may need an environmental impact assessment, and those which impact areas of high biodiversity value. The EIB also needs to commit to carry out site visits and engage with affected communities in such cases, and to be involved in any monitoring and corrective action. This must also be clearly stated in loan contracts.

But real improvements in the environmental and social performance of the EIB’s intermediated investments are only likely with increased transparency so the public can bring forward any concerns in a timely manner. EIB clients and the Bank itself must be required to publish information at the very least on sub-projects which are likely to have significant social or environmental effects before they are approved for financing.

1. Former IFC CEO Philippe Le Houérou in Opinion: A new IFC vision for greening banks in emerging markets, Devex, 8 October 2018: “…we have eliminated our general-purpose loans to any financial intermediaries; we now ring-fence about 95 percent of our lending to financial intermediaries…”.

This publication was produced in collaboration with EuroNatur in the framework of the joint research and advocacy work on hydropower finance and subsidies.

Never miss an update

We expose the risks of international public finance and bring critical updates from the ground – straight to your inbox.

Institution: EIB

Theme: financial intermediaries, Policy and Financial Intermediaries standard, EIB,

Tags: EIB | financial intermediaries