European Fund for Strategic Investments (EFSI)

Tasked with stimulating the European economy, the new investment fund may just become an extention of the European Investment Bank’s normal lending with very limited additional (green) finance.

Photographs: © European Union 2014 - European Parliament" (CC BY-NC-ND 2.0 - https://flic.kr/p/pVaFbL & https://flic.kr/p/pfXPUT )

Stay informed

We closely follow international public finance and bring critical updates from the ground.

Background

Facing protracted economic downturn in Europe, the European Commission in 2015 launched with great fanfare an Investment Plan for Europe with its financial arm, the European Fund for Strategic Investments (EFSI).

Under the auspices of the European Investment Bank, the EFSI aims to stimulate the European economy and mobilise private investments by providing funding for projects with a higher risk profile than ordinary EIB activities.

Yet although the fund has been tasked specifically with financing, among others, energy efficiency and renewable energy projects and with promoting cohesion, it may not live up to this promise.

There is a risk that, being managed by the EIB, the EFSI either follows standard EIB lending practices or that ‘greener’ EIB loans are shifted to the EFSI category – with very limited additional green finance overall.

Assessment after the first year of operation

An in-depth examination by Bankwatch of the EFSI’s operations after one year suggested that cash that should be flowing into projects that boost environmental sustainability is instead fuelling outdated carbon-intensive projects like motorways, airports, and fossil-fuel infrastructure.

An opinion by the European Court of Auditors confirms that evidence for the EFSI’s added value is scarce at best, as Reuters reported in November 2016.

Also beneficiaries and national promotional banks were in doubt about the added value of the fund, as an independent report by the consultancy Ernst & Young showed in November. The report also warned that the EFSI may even crowd out existing investments.

Read more:

The Best Laid Plans – Why the Investment Plan for Europe does not drive the sustainable energy transition

An article with highlights from the study

Good and bad projects

The good: “Third industrial revolution”

The “third industrial revolution” project in Nord-Pas-de-Calais, France incorporates numerous smaller projects all working for a zero carbon energy system for the entire region. The particular financing mix could potentially serve as a good example for an investment platform under EFSI.

The bad: Bratislava bypass

The EUR 1.76 billion public-private partnership project of a 27km motorway around Bratislava is filled with controversy. It will come with high costs, damage biodiversity and likely not solve local transport problems.

Background: funding set-up

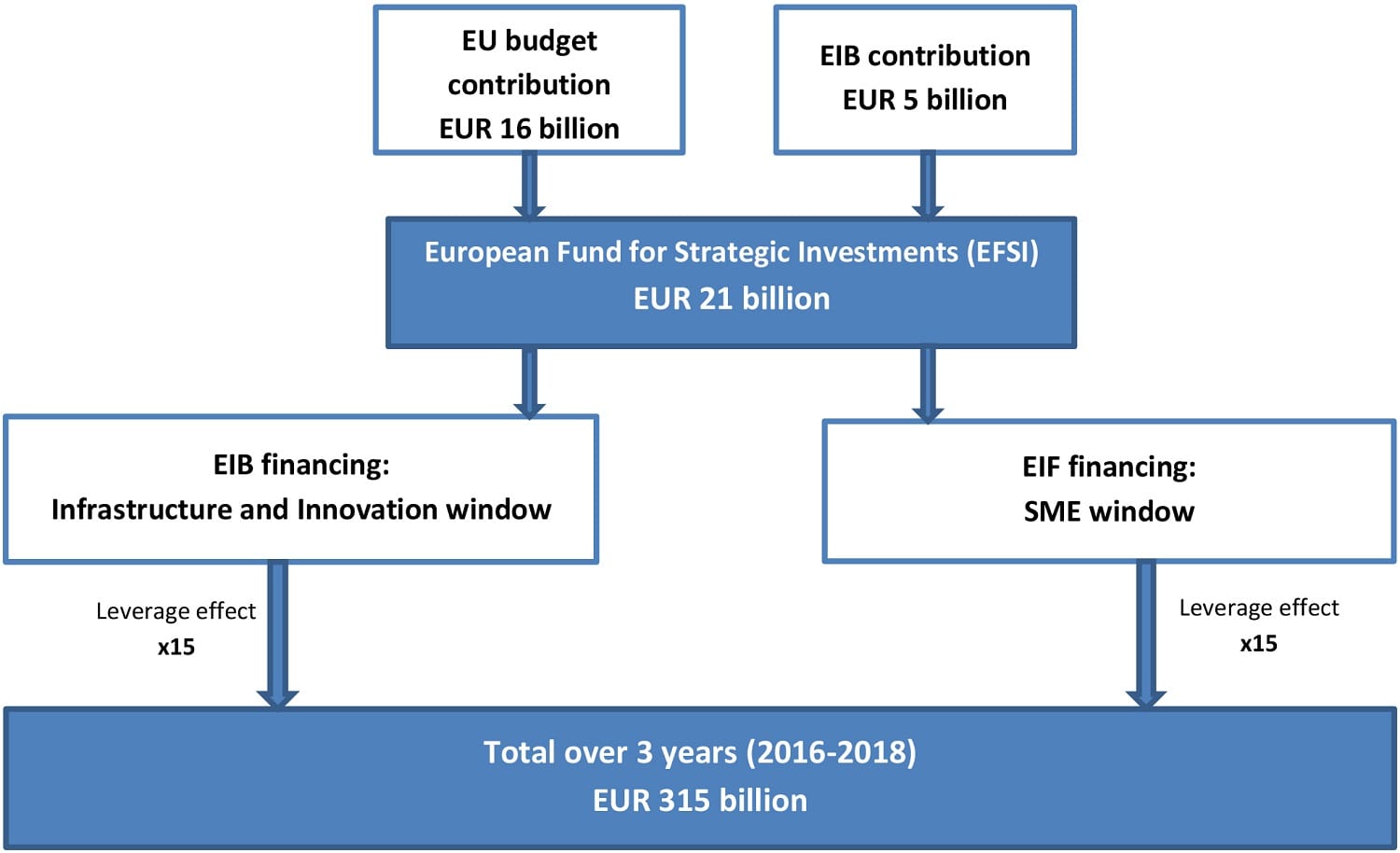

Based on a guarantee of EUR 16 billion from the EU budget and complemented by a EUR 5 billion allocation of the EIB’s own capital, the EFSI’s investment target is EUR 315 billion until 2018.

Latest news

Naše predsedníctvo za solidaritu

Bankwatch in the media | 14 July, 2016Začiatkom júla začalo Slovensko predsedať Rade Európskej únie. Uprostred politických turbulencií nielen u nás doma, ale aj v Európe sa slovenská vláda rozhodla podporiť zaznamenaniahodné nástroje ekonomickej politiky.

Read moreThe EU house bank is holding back Europe’s shift to sustainable energy

Press release | 14 June, 2016On the occasion of the EU Sustainable Energy Week, a new Bankwatch analysis shows that the European Investment Bank (EIB) has been effectively hindering Europe’s energy transition.

Read moreMEP Pirinski: “The EIB should pay more attention to economic, social and territorial cohesion”

Blog entry | 7 June, 2016MEP Georgi Pirinski, rapporteur of the annual report on the European Investment Bank, shares his views on how to improve the way the bank operates.

Read moreRelated publications

Doing the same thing and expecting different results?

Study | 10 November, 2017 | Download PDFAn analysis of the sustainability and transparency of the European Fund for Strategic Investments.

The winners and losers of climate action at the European Investment Bank

Briefing | 18 May, 2017 | Download PDFThis analysis of the bank’s climate action is based on the climate action database disclosed by the EIB. The database includes projects which were signed in 2016 and classified in line with the methodology approved by the bank in its Climate Strategy.

Bratislava D4/R7 Highway

Briefing | 5 May, 2017 | Download PDFThere have been a number of irregularities with the planning of the Bratislava D4/R7 project that have stirred public criticism about the imprudent spending of public money. This briefing presents a summary of the facts and allegations that can be seen