ARCHIVED: Southern Gas Corridor

This system of mega-pipelines meant to bring gas from Azerbaijan to Europe, is unnecessary for Europe’s declining gas demand. But the billions in public investments will boost Azerbaijan’s dictatorial regime and cause upheaval for transit communities in Turkey, Greece, Albania and Italy.

The route and the three pipelines of the Southern Gas Corridor.

Stay informed

We closely follow international public finance and bring critical updates from the ground.

Key facts

Costs: estimated at USD 45 billion Length: 3500 km Capacity: 16 billion cbm of gas annually Pipelines

- South Caucasus Pipeline extension (SCPx): Azerbaijan-Georgia

- Trans-Anatolian Pipeline (TANAP): Turkey

- Trans-Adriatic Pipeline (TAP): Greece-Albania-Italy

Gas supply

- Azerbaijan: Shah Deniz gas field, located in the Caspian Sea

- involvement of Turkmenistan and Iran so far only speculative

Key issues

- unprecedented support from public finance institutions more >>

- criminal and corrupt activities among companies building the pipeline more >>

- project would widen surplus in Europe’s gas import infrastructure and likely turn into stranded asset more >>

- contrary to EU Commission’s claim to reduce dependence on Russian gas imports, evidence of Moscow’s involvement is mounting

- adverse impacts on local communities in transit countries. more >>

- gas deal will strengthen Azerbaijan’s repressive regime that is cracking down on human rights defenders and journalists more >>

Background

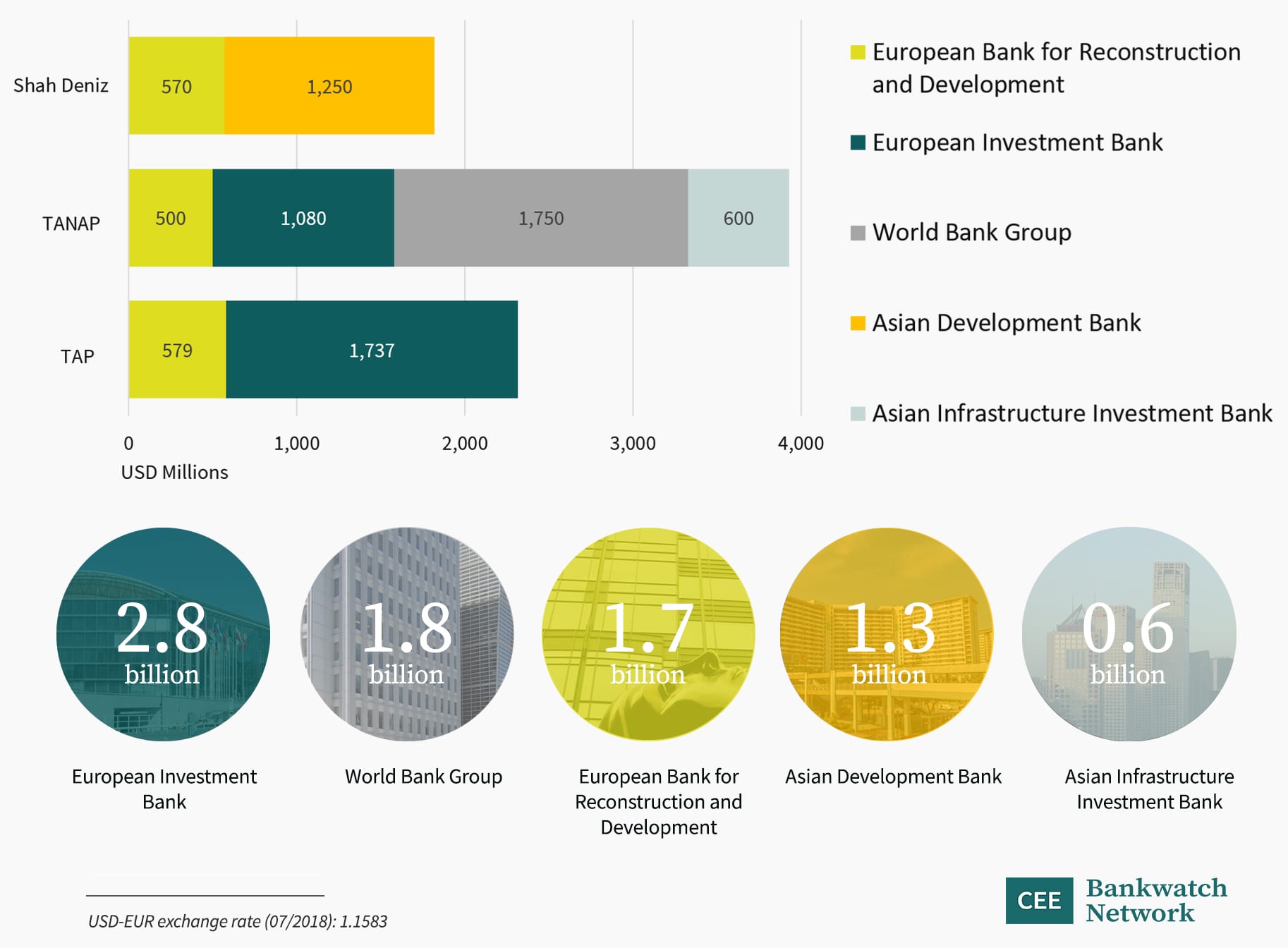

Record loans from public banks

Total: $8.1 billion

Colossal amounts of public money are being put on the line for a project that would lock in Europe with higher fossil fuel dependence and stranded assets.

Read more: Breakdown of approved and proposed public finance for the Southern Gas Corridor (Google sheet) Europe’s Keystone XL: Planned gas pipeline is reckless

The European Bank for Reconstruction and Development (EBRD) already approved three loans for the Shah Deniz stage 2 gas field (USD 200 million, USD 250 million and USD 100 million) as well as USD 500 million for TANAP and EUR 500 million for TAP. On top of USD 250 million for Shah Deniz stage II (as part of a package with the EBRD and commercial banks), the Asian Development Bank (ADB) approved in December 2016 an additional USD 1 billion for the Shah Deniz II gas field. The European Investment Bank (EIB) approved EUR 1.5 billion for TAP and EUR 932 million for TANAP. The World Bank approved two USD 400 million loans for Turkey and Azerbaijan for TANAP. The World Bank’s Multilateral Investment Guarantee Agency (MIGA) approved a guarantee of up to USD 950 million for TANAP against the risk of non-honoring of a sovereign financial obligation. The Asian Infrastructure Investment Bank (AIIB) approved a USD 600 million loan for TANAP at an unannounced extra-ordinary virtual Board meeting on December 21. (The AIIB’s project summary also states the combined EIB and EBRD support for TANAP as USD 2.1 billion, which suggests that, like the EIB, the EBRD is considering EUR 1 billion for TANAP.)

Read more:

See a breakdown of this overview, including information sources in a google sheet >>

Earlier loans

Earlier, already completed loans from the EBRD include support for the Southern Caucasus gas pipeline (SCP) (USD 70 million for Lukoil (2005) and USD 60 million for SOCAR (2004)) and the Shah Deniz gas field (USD 110 million for Lukoil (2005) and USD 100 million for SOCAR (2004)). Both Shah Deniz and the South Caucasus Pipeline are considered parts of the Southern Gas Corridor’s infrastructure as the EBRD’s Managing Director for Energy and Natural Resources, Riccardo Puliti has stated.

Backing from Brussels

The pipeline is a key element of the Energy Union, the European Commission’s flagship initiative. TAP could also benefit from financing through the Project Bond Initiative as a Project of Common Interest.

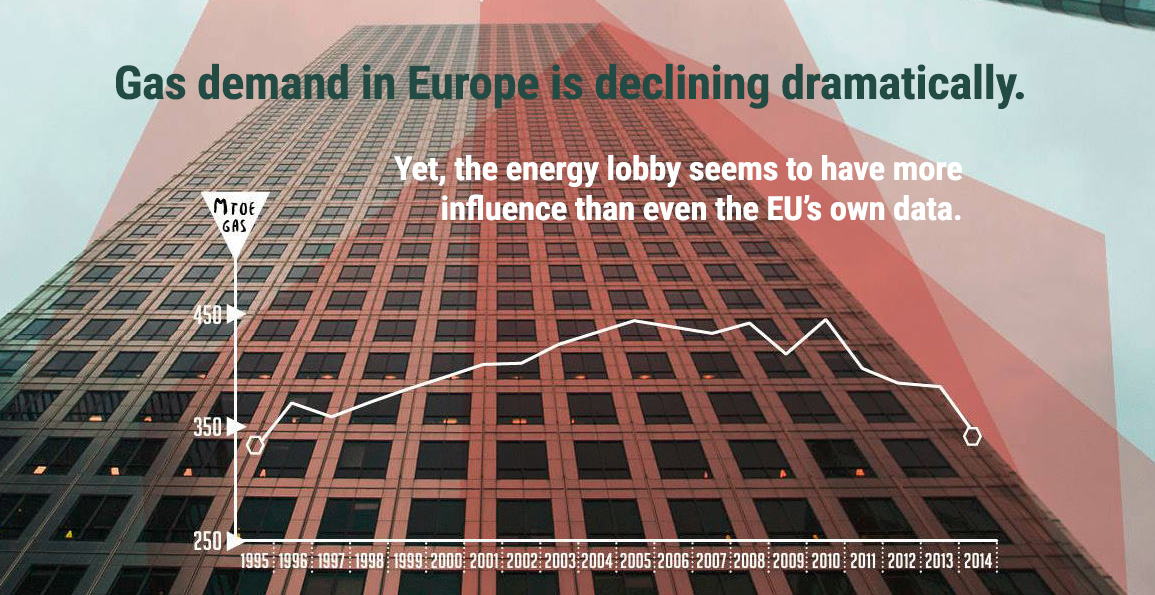

A predictable stranded asset

The EU already has an overall surplus of gas import infrastructure. Especially since the 2007 recession, gas demand has significantly decreased (pdf) and is not expected to bounce back until the 2020’s. The European Union’s 2050 Energy Strategy expects natural gas imports to further decrease under all scenarios. The 2020’s, when the pipeline is expected to be operational, should already mark a significant reduction in gas demand according to this roadmap. The Southern Gas Corridor would only widen the surplus in Europe’s gas import infrastructure and likely turn into a liability.

Massive new gas infrastructure like this will lock Europe into fossil fuels for decades and will lead to hundreds of millions of tonnes of CO2 emissions.

Read more: Pipe dreams – why public subsidies for Lukoil in Azerbaijan will not reduce EU dependency on Russia (Study) No security for Europe from the Southern Gas Corridor (Blog post)

Risky business – Who benefits from the Southern Gas Corridor?

No less than 15 firms contracted to build TAP and TANAP, the two main sections of the Southern Gas Corridor, have been implicated in various forms of corruption in the past.

Impacts and opposition in transit countries

Italy

The TAP pipeline is supposed to reach land in San Foca in the Melendugno municipality. San Foca has received European Blue Flags for not one but two beaches, awarding water quality and environmental management among others. Fearing the destruction of their coastline and negative effects on tourism, agriculture and fishery, local mayors and their constituencies are viciously opposing the TAP pipeline and the risks of accidents associated with the related infrastructure.

Resistance against the Trans-Adriatic Pipeline has been active for several years in the region. In the spring of 2017 the confrontation with the company escalated.

Read more: Italian communities block pipeline works to save ancient olive trees (Blog post)

Albania & Greece

Land acquisition for the pipeline and the compensation of local farmers has led to a number of grievances and irregularities in both Greece and Albania. Some farmers have lost the majority of their income while receiving a pittance in return. Read more: Last harvest looming for Albanian farmers along pipeline route Multimedia story | December 7, 2016 ‘We have no other option’ – Preparation of the Trans-Adriatic Pipeline in Albania (pdf) Study | August 4, 2016 When Athens can’t tell a Trojan horse Multimedia story | December 2, 2016

Turkey

The Trans Anatolian Pipeline (TANAP) pipeline will pass through twenty provinces in Turkey. It will create a high security, militarised corridor across the whole country, with costs estimated at USD 11.7 billion. Although Turkish officials claim that the pipeline will result in higher employment, lessons from the BTC pipeline indicate that locals may rather face loss of land and livelihoods, environmental problems and repression if they dare to protest.

“I was arrested and tortured for speaking out against the BTC pipeline. If the [Southern Gas Corridor] goes ahead, people living along it will experience the same repression.”

Ferhat Kaya, Turkish activist in the Ardahan province (Source: Platform)

Strengthening the dictatorship in Azerbaijan

In Azerbaijan the Aliyev family’s dictatorship has held onto power for the past two decades through a combination of holding fraudulent elections, prosecuting and assaulting critics and curtailing media freedom. During the October 2013 presidential elections almost 150 political prisoners were behind bars in Azerbaijan. The OSCE criticised the elections for failing to meet international standards on free and fair elections. Since summer 2014, ahead of the inaugural European Games in Azerbaijan, unprecedented levels of arrests and attacks on civil society, even by Azerbaijan’s standards, have occurred. By 2015 several renowned human rights defenders have been sentenced to years in prison. The OSCE was ordered by Azerbaijan to close their mission in the country. Critical voices, including the guardian and amnesty international, were banned from covering the European Games in Baku.

The EBRD’s founding mandate states that it must only work in countries that are committed to democratic principles. Azerbaijan is proving itself to be the opposite.

Read more:

A letter from an inmate of the Southern Gas Corridor Article by Ilgar Mammadov, an incarcerated Azerbaijani opposition leader No public money for Lukoil and mega gas project in Azerbaijan Open letter by the Sports for Rights campaign

Oil, gas, money, power

Without properly functioning democratic institutions, rule of law and effective checks and balances for the president’s powers, investments in Azerbaijan’s oil and gas sector will further cripple democracy in the country. Hydrocarbon revenues provide the Aliyevs with the finance needed to pay security forces and establish a secure income and therefore enabled them to ignore citizens’ voices because they are not reliant on those citizens for a tax base. Human rights activist Rasul Jafarov spoke about this shortly before his arrest. Referring to an earlier mega pipeline project that has equally been criticised, he said:

Before the oil and gas incomes came to Azerbaijan we had more democracy and freedom. The main income from oil came in 2005 when the Baku-Tbilisi-Ceyhan pipeline started to operate. And from that time the situation started to deteriorate.

Read more: Europe’s Caspian gas dreams – a nightmare come true for human rights in Azerbaijan Blog post | May 15, 2015 Sport for Rights to EBRD: No public money for Lukoil and mega gas project in Azerbaijan Advocacy letter | July 20, 2015

“Oil has kept autocrats in power by enabling them to increase spending, reduce taxes, buy the loyalty of the armed forces, and conceal their own corruption and incompetence…”

Micheal L. Ross, ‘The Oil Curse: How Petroleum Wealth Shapes the Development of Nations‘, 2012

BP

With total revenues of USD 358.7 billion for 2014 alone, British Petroleum (BP) is one of the world’s largest oil and gas companies. Yet, it is also renown for Deepwater Horizon, the largest marine oil spill in history.

SOCAR

The State Oil Company of Azerbaijan (revenues in 2014: USD 39.7 billion) is one of the strongest Azeri institutions holding the Aliyev dictatorship in place. SOCAR uses its own paramilitary force to silence journalists. It is known for a general lack of transparency and links to the Aliyev dictatorship.

Lukoil

Lukoil is the second largest Russian oil and gas company (revenues in 2013: USD 141.5 billion). Apart from the problem of entrusting a Russian company to diversify the EU away from Russian gas, Lukoil is responsible for numerous oil spills and accidents in Russia, while receiving money from the EBRD. See an overview of the shareholders of Shah Deniz and the three pipelines in this spreadsheet >>

Latest news

EU Ombudsman launches investigation into financing of Europe’s largest fossil fuels project

Press release | 17 December, 2020The European Investment Bank (EIB) has dangerously downplayed the contribution of the controversial Southern Gas Corridor to the unfolding climate crisis, according to a complaint that prompted the European Ombudsman to open a formal inquiry.

Read moreEIB keeps denying Southern Gas Corridor climate impact

Blog entry | 4 August, 2020As it seeks to morph into the EU’s climate bank, the European Investment Bank (EIB) continues to downplay the climate footprint of many of the projects it finances, including that of Europe’s largest fossil fuels project, the Southern Gas Corridor.

Read morebne IntelliNews – TANAP pipeline comes online, a major piece in Europe’s energy puzzle

Bankwatch in the media | 3 July, 2019Completion of the TANAP pipeline brings completion of the Southern Gas Corridor that will diversify Europe’s gas supplies away from Russia closer to reality — at a time when Russia is building its own new pipeline infrastructure. Source: bne IntelliNew

Read moreRelated publications

Azerbaijan, the European Neighbourhood Policy and the EU’s energy interest

Briefing | 17 November, 2015 | Download PDFAzerbaijan has been a part of the EU Neighbourhood Policy since 2004 and has enjoyed substantial support through investments in the energy sector. As a result of cooperation on energy projects, the EU is today Azerbaijan’s main trading partner, with bilateral trade amounting to more than EUR 16.7 billion in 2014. But while the European Commission’s 2014 progress report on Azerbaijan stressed the good progress in the EU’s partnership with Azerbaijan, problems for ordinary Azeris are increasing.

Infographic: How EU development funds fuel climate change

Leaflet | 17 November, 2015 | Download PDFA Bankwatch research into the EU’s development funds for neighbouring regions finds that considerably more European taxpayer money is supporting fossil fuels than facilitating a sustainable energy transition. This infographic belongs to a report presented in November 2015 to the European Parliament. See the report’s excutive summary >>

Publish What You Pay: ‘Lukoil loan would fundamentally contradict EBRD policies’

Advocacy letter | 21 July, 2015 | Download PDFThe Board of the Extractive Industries Transparency Initiative (EITI), a coalition of companies, governments, investors and civil society organisations has unanimously downgraded Azerbaijan to a “candidate country”. Azerbaijan will be suspended from the EITI in April 2016 if it does not comply with a set of requirements that ensure civil society can work freely in the country.