Established to promote the transition to market-oriented economies in countries committed to multiparty democracy, the EBRD’s lending often destroys nature and harms communities by failing to conduct proper human rights due diligence and informed public participation.

Alternative news on the EBRD

Despite heavily increasing investments in green projects in recent years, the EBRD still lacks an effective system for safeguarding human rights.

LATEST UPDATE

Background

Created after the fall of the Berlin Wall to promote the transition to a free-market economy, the European Bank for Reconstruction and Development (EBRD) is a leading institutional investor in Central and Eastern Europe, Central Asia and the Mediterranean regions. The bank is unique among multilateral development banks with its political mandate that commits its countries of operation to multiparty democracy, the rule of law and respect for human rights. The bank also has a strong mandate to promote sustainable development within ecological limits in the full range of its activities.

Despite its unique statute, the EBRD invests more than half of its portfolio in countries rated as authoritarian and hybrid regimes by the Economist Intelligence Unit. The bank’s newest Strategic and Capital Framework till 2025 foresees that only half of its portfolio will be green. Although the bank actively promotes a green economy and decarbonisation as key qualities of transition, it still invests in fossil fuels and carbon lock-in.

Our critique of the EBRD

Although the EBRD aims to align its investments with the Paris Agreement and to invest more than half of its portfolio in Green Economy Transition projects, the bank still invests in fossil fuels. Natural gas is no longer seen as a transition fuel, according to the International Energy Agency, so the EBRD urgently needs to review its energy and to develop a new climate strategy. EBRD’s investments should enable the just transition in our countries and a shift away from fossil fuels dependence and stranded carbon assets to carbon neutral development.

The EBRD has a well-developed and yet ineffective system for assessing political risks and safeguarding human rights. Unfortunately, there are many loopholes in this system that allow for projects to inflict harm on local communities and individuals, as our monitoring on the ground shows. The EBRD needs to plug the loopholes to ensure a watertight operational approach that delivers effective protection and promotion of human rights.

EBRD’s Crisis Response

The EBRD has responded promptly to the pandemic and the war in Ukraine with solidarity and resilience packages, as well as policy advice and analysis of best practice in areas such as occupational health and safety, digital governance, migration and support for refugees. The bank needs to ensure robust due diligence for its crisis response investments and compliance with transparency, sustainability and integrity standards.

Deteriorating democracy in EBRD countries

The EBRD was given a core mandate to promote a transition to market economy in former centrally planned economies, which was expected to go hand-in-hand with the democratisation of these countries.

Three decades down the road, the state of democracy, the rule of law and respect for human rights are deteriorating significantly in many EBRD recipient countries, whilst the Bank has done little to revisit its engagement.

More than just a few bad apples: If public engagement matters, why isn’t the EBRD tracking it?

Although the EBRD has a mandate to support the transition to democracy, data evaluating how well it performs this role remains scarce.

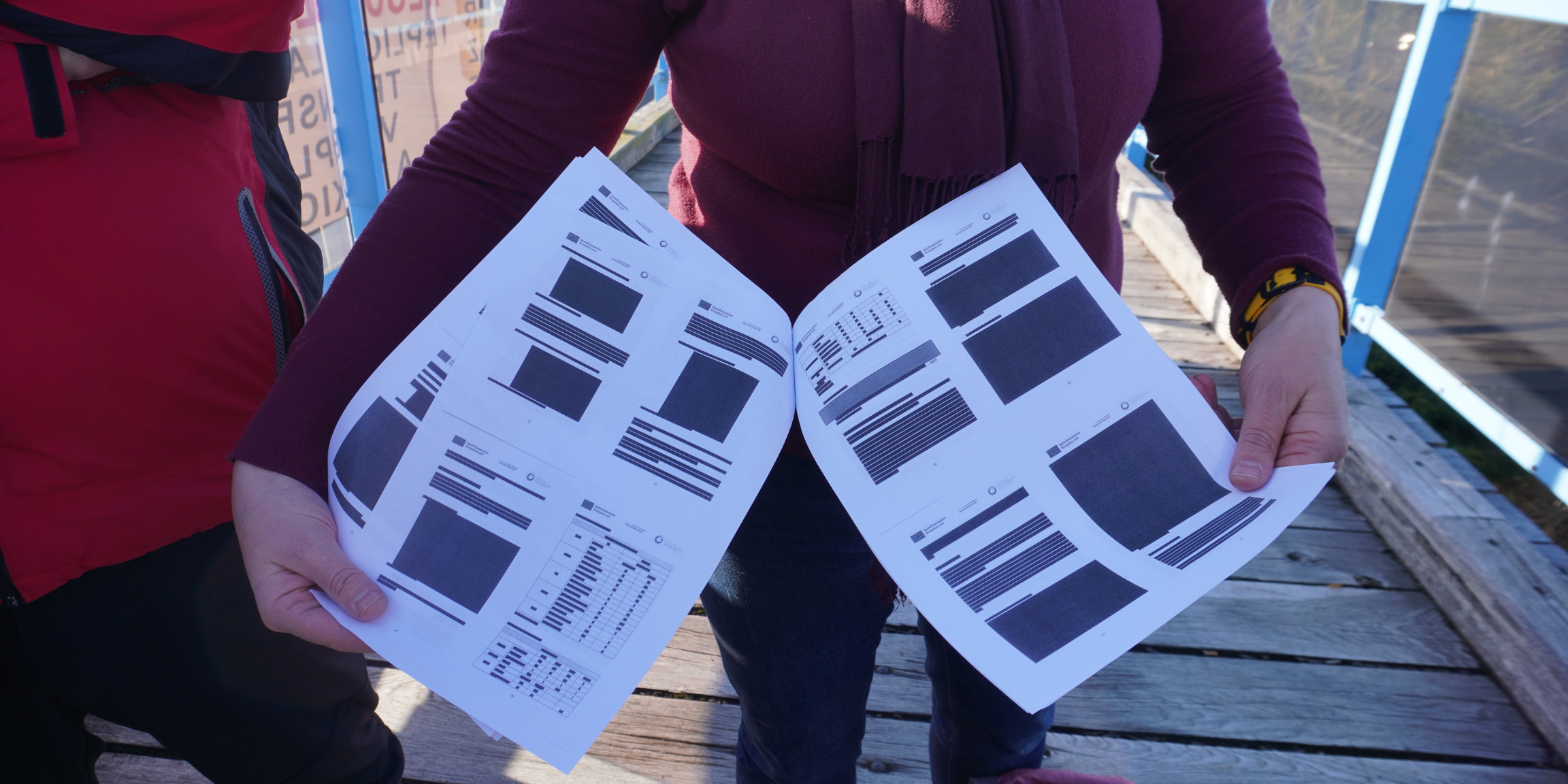

To demonstrate the value of this missing data, we gathered our own data on EBRD projects. With the help of our colleagues (including civil society organisations) and drawing on information from the EBRD Independent Project Accountability Mechanism (IPAM) Registry, we compiled data on 38 projects across 15 countries financed by the EBRD between 2009 and 2025. Using this data, we created a demonstration map to visualise emerging patterns related to concerns around public participation. The map provides detailed information on specific EBRD-backed projects, along with references to sources and public monitoring reports. For the full methodology, dataset and analysis, see our briefing.

FEATURED PUBLICATIONS

Monitoring what matters: Public participation as a systemic issue for the EBRD

Information on public participation practices reported by the EBRD is lacking. This briefing illustrates the importance of regular and effective monitoring of project-level participation to inform the EBRD’s corrective actions and enhance management strategies.

Civil society joint statement on the EBRD’s draft safeguards

Despite some improvements, the latest drafts of the EBRD’s updated good governance policies fall short of ensuring that human rights are respected and protected, especially in countries with significant democratic deficits. In a joint statement, 60 civil society organisations urge the EBRD to enhance its human rights due diligence.

Can the EBRD deliver effective sustainable infrastructure in the transport and municipal sectors?

This briefing makes recommendations aimed at contributing to the preparation of the EBRD’s new Sustainable Infrastructure Strategy for the period 2025 to 2029, which will merge the EBRD’s Municipal and Environmental Infrastructure (MEI) Sector Strategy and Transport Sector Strategy into one updated document. The information shared in this briefing is drawn from Bankwatch’s on-the-ground experience with EBRD investments in Armenia, Bosnia and Herzegovina (BiH), Georgia, Kyrgyzstan, Serbia and Uzbekistan.

EBRD PROJECTS WE MONITOR

Indorama Agro: Uzbekistan’s infamous cotton producer

Despite being Uzbekistan’s largest cotton producer and receiving millions in development loans from the European Bank for Reconstruction and Development (EBRD), the Asian Development Bank (ADB) and the International Finance Corporation (IFC) – institutions that promote modernisation and corporate responsibility – Indorama Agro faces multiple complaints of worker mistreatment and retaliation.

Read more

Zarafshan, Bash and Dzhankeldy wind projects, Uzbekistan

The first large wind projects in the Central Asian country are being built in biodiversity hotspots and hinder the declaration of protected areas. The IFC, EBRD and ADB need to ensure that some of the most problematic turbines are moved away.

Read more

The Khada Valley, Georgia

The Khada Valley in Georgia brings together exceptional biodiversity, precious cultural and archeological heritage, and mountainous villages which have preserved rich traditions and historical lifestyles. But all of this might vanish if a 23-kilometer road from Georgia to Russia – the Kvesheti-Kobi project – is built.

Read more

LATEST UPDATES

Monitoring what matters: Public participation as a systemic issue for the EBRD

Publication | 11 December, 2025Information on public participation practices reported by the EBRD is lacking. This briefing illustrates the importance of regular and effective monitoring of project-level participation to inform the EBRD’s corrective actions and enhance management strategies.

Read more

More than just a few bad apples: If public engagement matters, why isn’t the EBRD tracking it?

Story | 11 December, 2025Civil society organisations and accountability mechanisms have repeatedly highlighted EBRD-financed projects in which the people affected have been marginalised, consultations have been superficial, and grievances have been ignored. These are not isolated missteps or the work of a few bad apples, but rather recurring problems that result in serious harm to people and the environment. Our latest research identifies 38 such cases, raising a pressing question: How can the EBRD ensure meaningful public participation if it doesn’t identify and learn from its failures?

Read more

Replicability gone wrong: Demolition of cultural heritage and environmental risks at EBRD project in Kazakhstan

Blog entry | 8 December, 2025For years, concerns have been raised about the Almaty International Airport Extension Project which is being financed by the European Bank for Reconstruction and Development (EBRD). Locals question the inadequate protection of cultural heritage and a lack of public participation and access to information. To address this, a formal complaint was recently filed with the Independent Project Accountability Mechanism (IPAM), and the outcome of a compliance review is pending.

Read more